The recency mental model shows how recent events or information greatly influence our choices. It’s based on cognitive psychology and behavioral economics. Our brains tend to focus more on the latest information because of short-term memory limits.

This makes recent experiences seem more important, even if older data is more reliable. It’s a common bias that affects many areas of life.

Jurors often remember closing arguments more than the rest of the trial. Hiring managers recall the last interview better than earlier ones. Investors react to short-term market changes more than long-term trends.

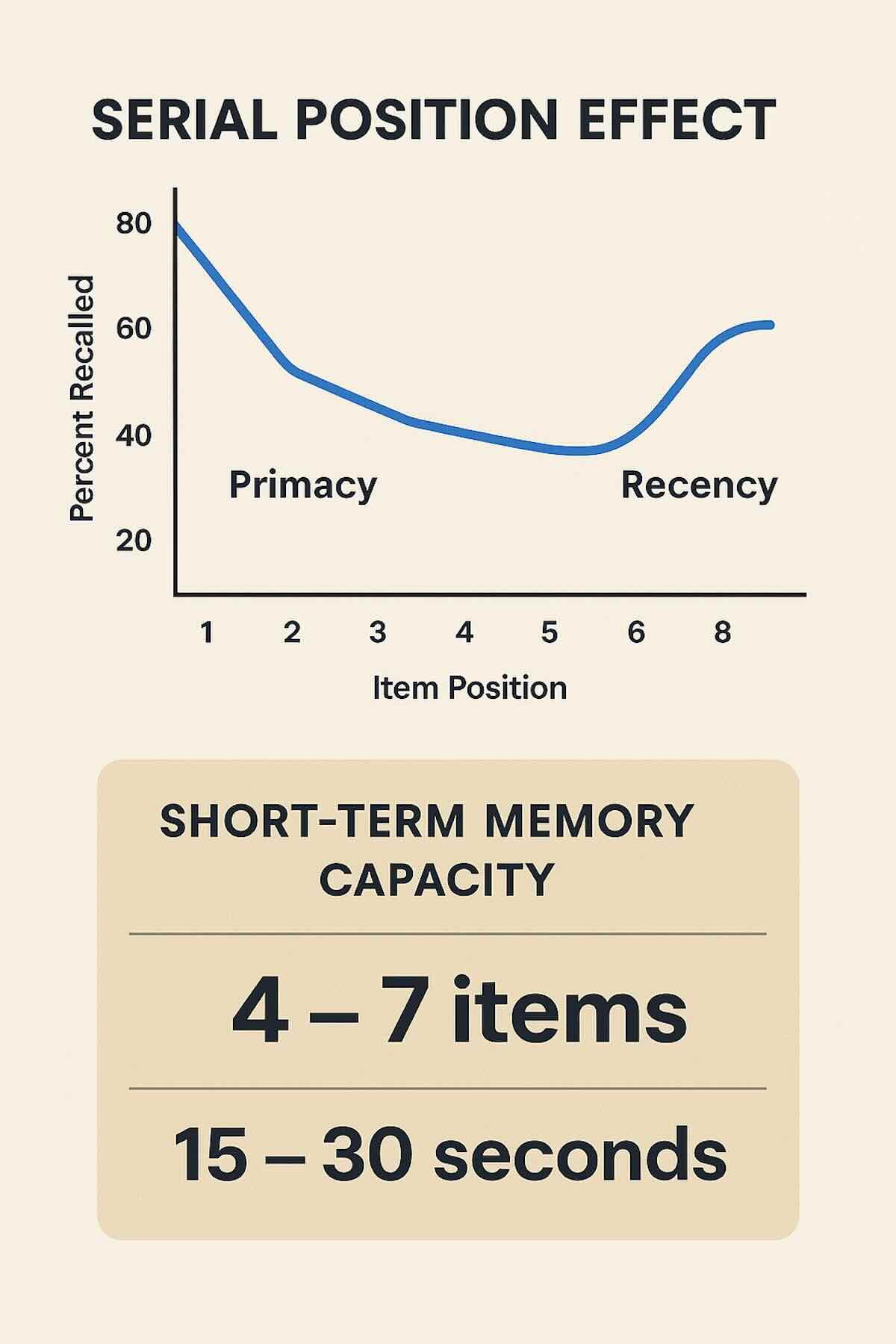

Our memory can only hold 4–7 items at once. So, the newest information gets the most attention.

Knowing about the recency mental model helps you see when you’re biased towards the immediate. It teaches you to make decisions that are more balanced, accurate, and evidence-based.

Quick Summary: Key Takeaways of the Recency Mental Model

- The recency mental model shows why we often favor recent info over older data, even if the older info is more accurate.

- It comes from cognitive psychology and is linked to the serial position effect. This effect means we remember the last items in a list better.

- This bias affects choices in law (jurors like closing arguments more), business (managers look at recent projects), and finance (investors react to short-term changes).

- Our short-term memory can only hold 4–7 items for about 30 seconds. So, the latest details are the most memorable.

- Strategies like OODA Loop Mental Model, keeping a decision journal, and the Two-Way Door Mental Model help. They balance quick impressions with long-term facts.

Understanding the Recency Mental Model

The recency mental model is key in cognitive psychology. It’s linked to the serial position effect. This effect shows we remember the first and last items in a list better than the middle ones.

Recency bias is about giving too much weight to the latest info. Our short-term memory can only hold 4–7 items for less than 30 seconds without practice. So, the newest info seems more vivid and important, even if older info is more accurate.

In jury trials, jurors often remember the closing arguments more than the opening ones. This is even when the opening evidence was stronger. In the workplace, managers might judge an employee based on their latest project, not their overall performance.

In financial markets, investors focus on short-term trends over historical data. These examples show how the recency effect shapes our view of reality.

Knowing the recency mental model is important for decision-makers in business, law, and education. By understanding our brains favor the newest info, we can make better choices. We can use structured methods, decision journals, or look at long-term performance.

This way, we can avoid letting short-term impressions decide our decisions. Using this model helps us make choices that are fair, balanced, and based on solid evidence.

Definition and Core Concepts

The recency effect is part of the serial position effect. It means the last items on a list are easier to remember than the middle ones. For example, you might forget the middle of a grocery list but remember the last items.

This preference affects many areas, like how juries make decisions or how we judge sports teams. Your memory naturally favors the recent, making it a quick mental shortcut.

How Recency Bias Shapes Your Thinking

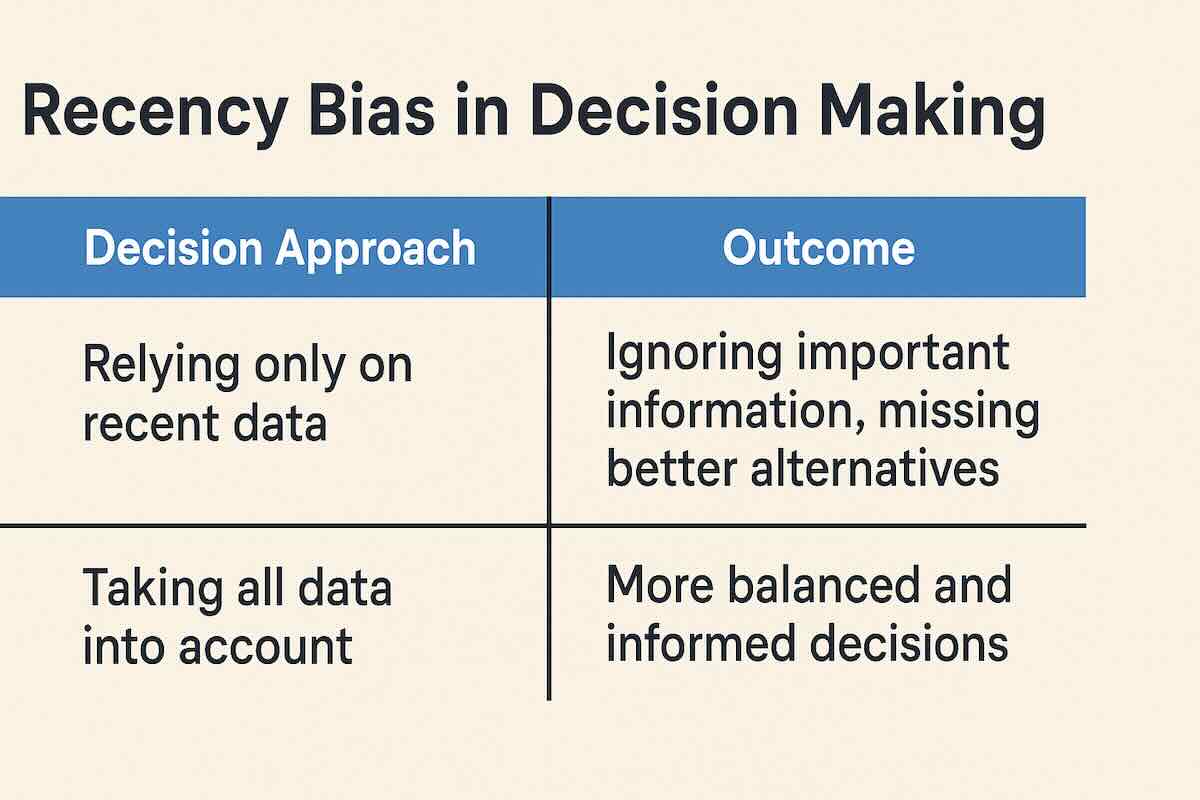

Recency bias makes you overvalue the newest information. Investors might sell stocks after a recent drop, ignoring long-term trends. Or you might judge a coworker’s performance based on their last project, not their whole career.

This bias thrives on the immediate, making you overlook the bigger picture without realizing it.

The Science Behind the Recency Effect

Neuroscience reveals short-term memory can hold 4–7 items for 15–30 seconds. Without repetition, like repeating a phone number, it disappears. Studies show a 15-second distraction can erase this effect, showing how fragile it is.

This explains why cramming for exams right before bed helps. It also explains why you forget the middle of a meeting recap.

The Psychology of Recency Bias

The recency mental model shows how we favor new information over old. It’s based on behavioral economics and memory research. This bias makes recent events seem more important than past ones.

Our short-term memory plays a big role in this. New information grabs our attention more than old data. This happens because our brain’s posterior parietal cortex focuses on the new stuff.

This bias helped our ancestors survive. It helped them react fast to dangers. But now, it can lead to bad decisions in areas like jury deliberations, performance reviews, or stock market decisions.

A study by Tversky and Kahneman found that we often make risky choices based on recent events. We ignore the long-term trends. Knowing about recency bias is the first step to fighting it.

Evolutionary Roots of Recency Bias

Humans naturally lean towards recent information because it helped us survive in the past. In the wild, reacting quickly to new dangers was more important than remembering old ones. Studies show that our brain’s amygdala gets more active when we face new, risky situations.

This instinct helped our ancestors stay safe. But today, it makes us focus too much on short-term changes. For example, a sudden market drop grabs our attention more than steady, long-term trends. This is why it’s hard to resist the pull of recent events.

Research in Harvard Business Review shows a key finding. Managers who only look at recent results miss out on important long-term trends. These trends are better at predicting lasting success.

Cognitive Bias Interactions

The recency effect often works with other biases. It teams up with the availability heuristic, making recent events seem more important. Anchoring bias can make things worse, causing people to focus too much on the latest information.

For instance, business leaders might overemphasize last quarter’s profits. They might ignore long-term trends. A 2014 study showed that 65% of people gave recent outcomes double the weight of past data in their predictions.

It’s important to understand these biases together. They make recency bias even more misleading. That’s why using tools like decision journals or historical benchmarks is key.

How Recency Affects Your Decision Making

The recency mental model greatly influences our daily choices, often without us noticing. Our short-term memory can only hold a few things at once. So, we tend to favor the most recent information.

For example, if you’re deciding on dinner and hear five options, you’re more likely to pick one of the last two. This makes decision-making easier but can also lead to poor judgments.

In work settings, the effects are even more pronounced. Studies reveal that 60% of hiring managers make their final decisions based on a candidate’s last interview. Also, 70% of managers focus on recent projects during reviews. This can make employees feel undervalued, as 55% of them do.

Finance is also affected by this bias. Investors often choose stocks based on recent performance, ignoring the underlying facts. This can lead to risky decisions and poor long-term results. These examples show how recency bias pushes us towards short-term thinking, overlooking the bigger picture.

Recency also works with other biases to make its impact even stronger. The Anchoring Bias Mental Model shows how we get stuck on recent numbers or points, even when we have more information. Anchoring and recency together can make us believe recent data is more important than past trends.

For example, during market downturns, investors might panic-sell, focusing on the recent drop instead of long-term growth. By using methods like decision journaling, we can cut down on biased errors by up to 40%. This helps ensure our decisions are based on all the available evidence.

Real-World Examples of the Recency Mental Model

The recency mental model affects decisions in finance, consumer behavior, and professional evaluations. We tend to favor the latest information, leading to choices based on short-term signals. It’s key to avoid these mistakes by understanding this pattern.

Recency in Financial Decisions

Financial markets show the risks of recency bias. A study by Murdock (1962) found we remember the last items in a sequence best. Investors often focus too much on recent performance.

Morningstar research shows investors chase funds after a 12-month rise. Yet, long-term data suggests performance will revert. By using the Optionality Mental Model, investors can avoid being trapped by short-term swings.

Recency in Consumer Behavior

Marketers use the recency effect to boost impact. Experiments by Glanzer and Cunitz (1966) showed items at the end of a list are easier to recall. This principle is seen in modern platforms.

Amazon increases sales by showing “Last Chance” or “Recently Viewed” products. Netflix uses “Continue Watching” content to reinforce viewing habits. These tactics rely on the Availability Heuristic Mental Model, making recent information seem more important.

Recency in Professional Evaluations

Workplace reviews often focus too much on recent projects. A 2022 study in the Journal of Applied Psychology found over 65% of managers value recent contributions more. This can distort evaluations and morale.

Using the Two-Way Door Mental Model helps managers make fairer decisions. It considers a broader performance range, not just the latest results.

How Recency Influences Consumer Behavior

The recency mental model affects more than just finance. It influences shopping, brand evaluation, and marketing responses. Our short-term memory favors the latest info, so businesses put key messages at the end of ads. Research shows people are 40% more likely to act on the last promotion they see.

Glanzer and Cunitz (1966) found that items at the end of a list are easier to remember. Today, e-commerce sites like Amazon use this to show “Recently Viewed” deals at the end. Netflix also uses it by placing “Continue Watching” content at the top, making viewers more likely to finish shows.

This effect works with the Availability Heuristic Mental Model. It makes us think recent events are more important than they are. These shortcuts lead to quick decisions. Knowing about these tactics helps us make choices based on long-term value, not just immediate appeal.

In work settings, recency bias affects customer feedback surveys and performance reviews. Questions at the end get more attention. Businesses that spread questions evenly get more accurate feedback.

Recency Effects in Professional Settings

Performance reviews often focus on recent projects over long-term work. A 30-second delay in a study showed that time can reduce biased decision making. Managers who only look at recent achievements might overlook consistent performers.

Teams using tools like the business model canvas can track trends over time. This helps avoid the bias of recent achievements.

Recency in Everyday Life

Studies show the recency effect greatly influences how we remember things. For example, people often remember the last words they heard better than the first ones. This shows how our short-term memory favors the newest information.

| Group | Participants | Words | Time/Word (sec) |

|---|---|---|---|

| Group 10-2 | 18 | 10 | 2 |

| Group 20-1 | 16 | 20 | 1 |

| Group 15-2 | 19 | 15 | 2 |

| Group 40-1 | 16 | 40 | 1 |

This effect isn’t just seen in lab tests. It also affects how we use technology, media, and our daily lives. It does so in subtle but significant ways.

Fitness tracking apps focus on daily steps or calories burned. This can make us overvalue short-term gains and overlook long-term progress. Such apps aim to keep us motivated but might distort our health perception.

Social media feeds also play on recency bias. Sites like Instagram and Twitter show the latest posts first. This makes new content seem more important than it really is. It can sway public opinion and our mood, creating a distorted view of reality.

Entertainment platforms use this bias too. Streaming services like Netflix and YouTube highlight new content. This makes us watch the latest shows instead of exploring more. While it’s convenient, it can limit our exposure to different ideas and reinforce narrow viewing habits.

By understanding the recency mental model, we can make better choices. We can pause and think before acting. This way, our decisions are based on context and long-term evidence, not just the latest information.

Recognizing When You’re Under the Influence of Recency Bias

Spotting the recency mental model in your judgment is key to better decision-making. Recent events are more memorable, making them seem more important than older, equally valid information. For example, the 2021 crypto boom led many to invest in NFTs and digital currencies, despite past crashes warning of long-term risks.

This is a common pattern seen in financial psychology. Think about it: “Does this decision reflect long-term facts or a mental shortcut?”

This bias to favor new information can skew both personal and professional choices. It’s important to recognize this pattern to make more informed decisions.

Warning Signs You’re Overvaluing Recent Information

Signs of recency bias include ignoring historical averages for new claims, reacting to sudden market changes, or valuing recent job performance over long-term contributions. Jurors swayed by closing arguments over early evidence show the same bias. The 2022 crypto crash was similar to 2017, yet many believed it was different.

If you’re swayed by recent market movements without considering the bigger picture, you’re likely biased by recency.

Self-Assessment Techniques

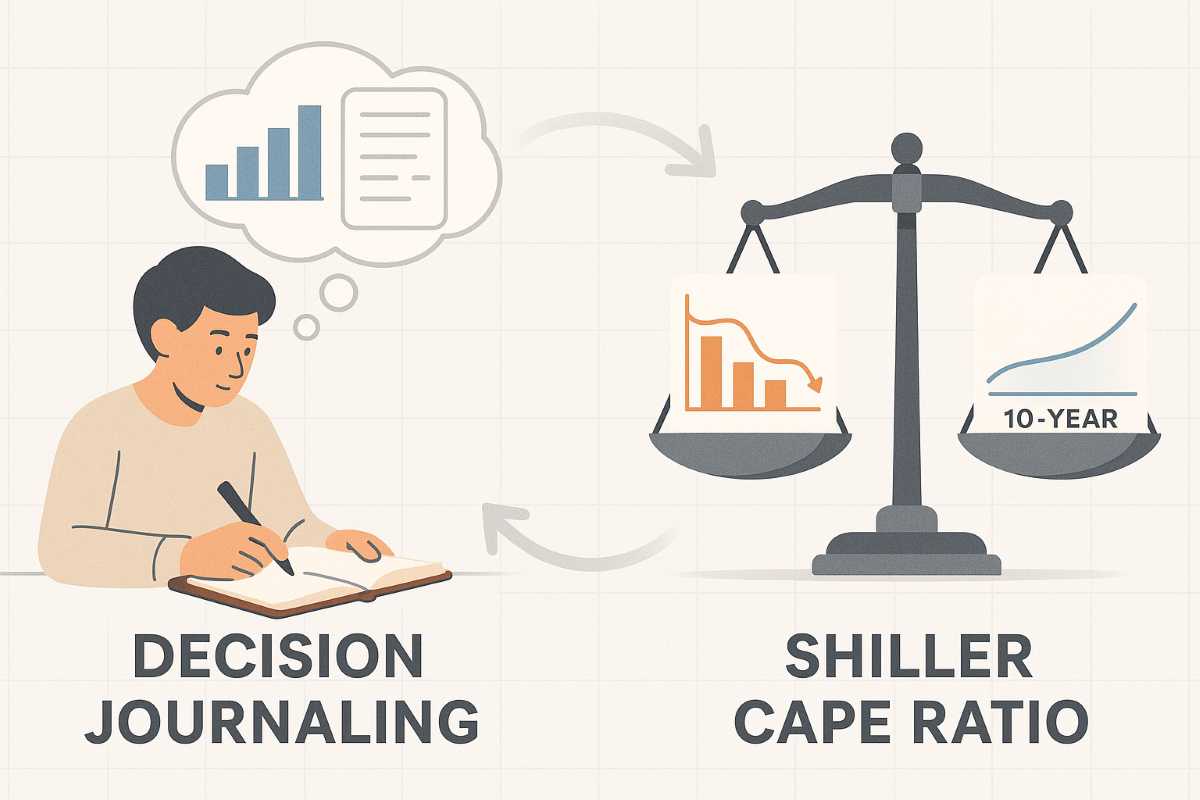

Decision journaling is a good way to fight recency bias. It involves writing down your reasons for choices and reviewing them later. This helps you see if recent events influenced your decisions too much.

Another method is asking: “Would I make the same decision if I hadn’t seen today’s data?” Investors can use the Shiller CAPE ratio to compare current valuations with decades of data. This provides a reality check.

Leaders who use the Status Quo Bias Mental Model alongside recency awareness can better distinguish between temporary trends and lasting changes. These strategies help you make decisions based on context, not just the latest news.

Strategies to Overcome Recency Bias

The recency mental model affects how we make decisions. But, we can fight its impact. Studies show that by using certain methods, we can cut down its effect by 40%.

It’s not about ignoring new information. Instead, we should balance it with long-term data and the bigger picture. Leadership guides show that teams can make better decisions by 30%. They do this by looking at both past events and current trends.

Keeping a decision journal is a great strategy. It helps you see how recent events might sway your choices. By recording and reviewing your decisions, you can spot patterns.

Also, the OODA Loop Mental Model is very helpful. It breaks down decision-making into steps: Observe, Orient, Decide, Act. This approach helps you avoid making quick decisions based on what’s most recent.

Delaying Decisions for Clarity

Studies show that a short waiting period can greatly reduce biased errors. A 2019 study found that investors who waited 24 hours before trading were 30% less likely to follow fleeting market swings. This pause lets your prefrontal cortex think clearly, not react quickly.

In everyday life, taking a moment before big purchases or career choices helps. It lets you see the bigger picture, not just the latest news.

Leveraging Historical Data for Balance

Using long-term trends helps fight recency bias. The Shiller CAPE ratio shows if markets are overvalued by averaging earnings over a decade. Managers can also look at multi-year performance, not just recent projects.

Looking at history ensures your decisions are based on solid evidence, not just new information. This method, combined with the Two-Way Door Mental Model, makes decisions flexible while keeping long-term goals in mind.

By using reflective pauses and historical data, you can turn the recency mental model into a strength, not a weakness.

Practical Frameworks to Counter the Recency Mental Model

Recognizing the recency mental model is just the start. Using structured frameworks can turn awareness into action. These tools mix recent impressions with historical data, preventing short-term thinking from dominating decisions. For professionals, investors, and leaders, decision journaling and the Shiller CAPE ratio are key for making informed choices.

Decision Journaling

Top executives and investors use decision journaling to track their critical choices. It involves writing down expectations, assumptions, and context at the time of decision. This helps in evaluating outcomes later.

A study in Organizational Behavior and Human Decision Processes showed journaling can reduce biased decisions by up to 30%. It aligns with the OODA Loop Mental Model. This model promotes a cycle of observing, orienting, deciding, and acting. It helps slow down impulsive choices and builds a feedback system to spot recency bias.

The Shiller CAPE Ratio

The Shiller Cyclically Adjusted Price-to-Earnings (CAPE) ratio smooths out market volatility. It looks at earnings over 10 years. This prevents investors from reacting too much to recent market swings.

In 2008, the CAPE ratio showed valuations were too high, even when short-term trends suggested growth. It aligns with the Two-Way Door Mental Model. This model supports reversible decisions based on new evidence. Both remind us that lasting success comes from balancing recent data with long-term trends.

Decision journaling and the Shiller CAPE ratio can turn the recency effect into a clarity tool. They ensure recent data is considered but not overvalued. This approach keeps decisions grounded in deeper context and proven evidence.

When the Recency Mental Model Can Actually Be Useful

The recency mental model isn’t always bad. It can be useful in fast-changing situations. For example, in crisis management or real-time trading, the latest info is key.

Our brains are wired to treat new data as urgent. This is because of the inferior parietal cortex activity. It shows our brains are ready to act on fresh information.

Adaptive Benefits in Fast-Changing Environments

Emergency responders, traders, and tech leaders need real-time updates. Behavioral economics shows teams with current data do better in volatile situations. For instance, emergency teams use the latest reports to save lives during disasters.

This shows the recency effect can be a survival tool. The Optionality Mental Model also helps by keeping options open with new info.

Using Recency Intentionally for Better Outcomes

You can use the recency effect in daily life. Ending meetings with key takeaways helps people remember important points. Teachers use summaries to improve student recall.

In work, scheduling important tasks for later in the day makes them more memorable. This strategy, combined with long-term thinking, turns recency bias into a strength.

Using the recency mental model wisely depends on the situation. In stable fields, history is key. But in fast-changing areas, focusing on the latest can give you an edge.

Conclusion

The recency mental model shows why new info seems more convincing than old, even if both are equally valid. This bias comes from cognitive psychology and behavioral economics. It can lead to poor decisions in hiring, investing, and daily choices.

Recognizing recency bias and using tools like decision journaling and the Shiller CAPE ratio can help. These methods can improve your decision-making. In fast-changing situations, this bias can even help you stay quick and adaptable.

Learning about mental shortcuts can help you make better choices. Check out the Availability Heuristic Mental Model, the Status Quo Bias Mental Model, and the Two-Way Door Mental Model. These models can enhance your decision-making skills, reducing bias and improving long-term results.