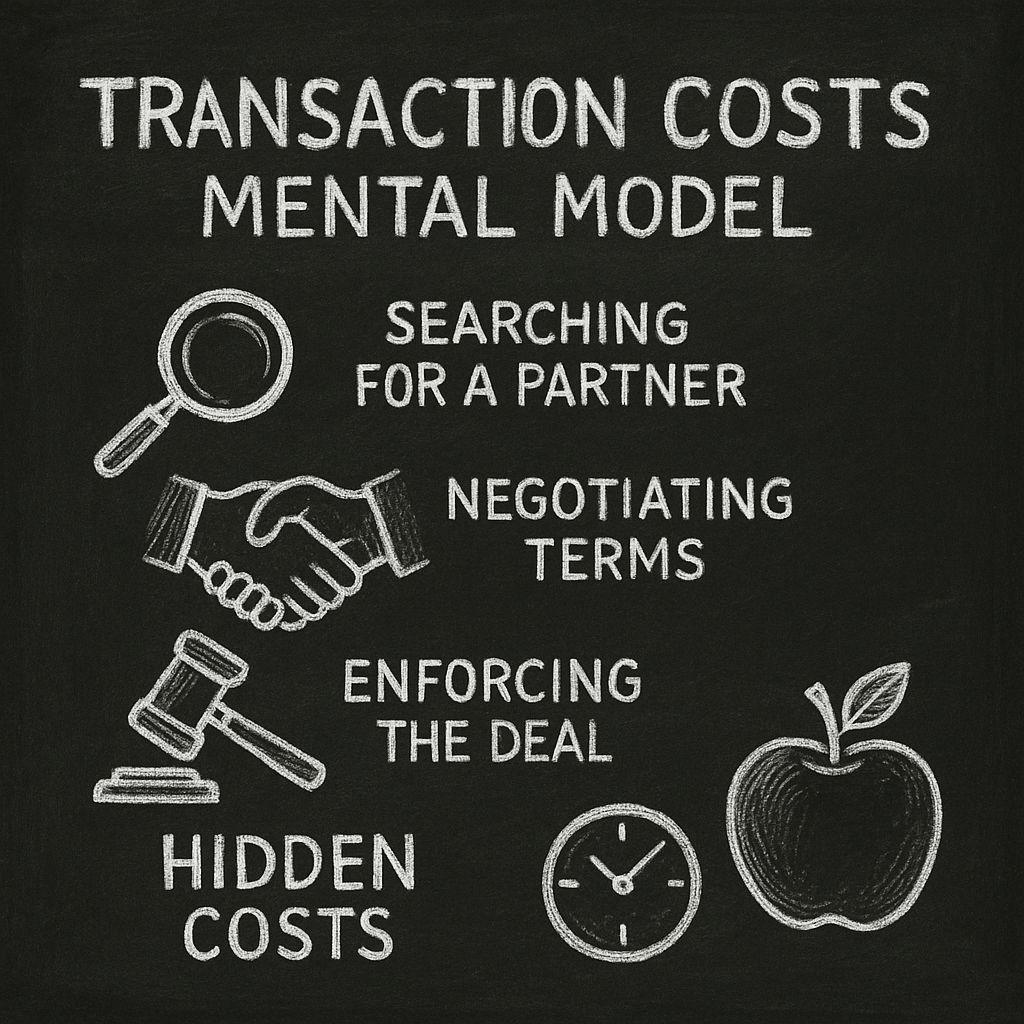

Ever wonder why some deals feel more exhausting than they’re worth? The transaction costs mental model helps explain this. It’s not just about the money you pay upfront—it’s about the hidden effort, time, and risks that come with every agreement. Imagine buying a car: the price tag is clear, but what about the hours spent researching, haggling, or fixing surprises later?

This framework teaches us to look beyond the obvious. Think of tasks like finding reliable partners, drafting contracts, or managing misunderstandings. These “invisible” hurdles add up, draining energy and resources. For example, businesses often debate outsourcing versus handling projects internally. Outsourcing might save money, but coordinating with external teams can create new headaches.

Even small choices, like signing up for a subscription service, involve hidden work. Reading terms, canceling auto-renewals, or resolving billing errors—these all count. By recognizing these factors upfront, you can make smarter, less stressful decisions.

Key Takeaways

- Every deal includes hidden effort beyond the initial price.

- Factors like research, negotiation, and enforcement often go unnoticed.

- Cognitive challenges and paperwork are part of the “real cost.”

- Applies to business strategies like outsourcing vs. in-house work.

- Modern tools (e.g., smart contracts) can reduce these burdens.

Introduction to the Transaction Costs Mental Model

Why do some purchases leave us drained even when the price seems fair? The answer lies in hidden factors that shape every agreement. Think of buying concert tickets: the listed amount is clear, but what about the hours spent comparing vendors or the stress of potential scams? This framework reveals the unseen work behind every choice.

Customers often face indirect expenses beyond the sticker price. For example, negotiating terms with a contractor or resolving billing errors with a subscription service eats into time and energy. These challenges influence preferences, making some options feel “too expensive” even if their upfront cost is low.

| Type of Hidden Expense | Customer Impact | Business Strategy |

|---|---|---|

| Research Time | Delayed decisions | Transparent pricing |

| Enforcement Effort | Trust erosion | Automated solutions |

| Risk Evaluation | Choice paralysis | Guarantees/warranties |

Businesses that grasp these layers can design better pricing strategies. A coffee shop might offer loyalty programs to reduce decision fatigue, while a software company could simplify contract terms. When companies address these friction points, they align with customer priorities—saving both sides from future headaches.

Ever tried returning an online order? The process often involves tracking policies, repackaging items, and waiting for refunds. These real-world pains show why weighing all factors—not just dollars—leads to smarter choices.

Breaking Down The Hidden Costs Behind Deals

Have you ever spent hours comparing vendors only to feel overwhelmed before even making a purchase? The effort behind agreements often goes unnoticed—like untangling headphones stuffed in your pocket.

Let’s unpack two major pain points that drain energy and contribute to mental transaction costs long before deals get finalized.

Searching for the Right Partner

Finding reliable collaborators can feel like dating. Imagine a bakery owner needing a flour supplier. They might sift through dozens of websites, read reviews, and test samples—all while worrying about delays or quality issues. This hunt eats into time that could be spent baking croissants or connecting with customers.

Studies show cognitive costs—the mental effort of decision-making—are a top hurdle in business relationships. Even tools like Google Reviews don’t eliminate the “analysis paralysis” many people face. That’s why intuitive user interfaces on platforms like Shopify or Fiverr simplify partner searches, turning weeks of research into a few clicks.

Negotiation and Enforcement Risks

Agreeing on terms is just the start. Picture a freelance designer negotiating a project timeline. Back-and-forth emails about deadlines, revisions, and payments can stretch over days. If the client disappears after delivery? Chasing payments adds stress no contract fully prevents.

These layers of friction impact real-world choices. A 2022 survey found 68% of small businesses avoid partnerships due to fears of enforcement headaches. For everyday people, it’s like arguing with a phone company over hidden fees—exhausting, but often unavoidable.

By acknowledging these invisible hurdles, we save money, time, and sanity. After all, good deals aren’t just about numbers—they’re about preserving peace of mind in a chaotic world.

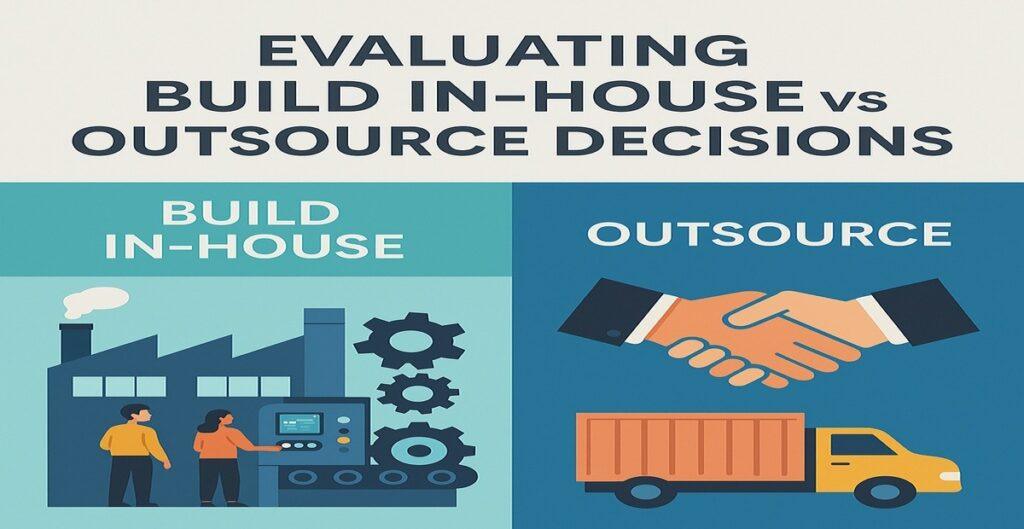

Evaluating Build In-House vs. Outsource Decisions

What keeps small businesses awake at 3 AM? Often, it’s the choice between handling tasks internally or paying someone else.

Let’s explore how hidden hurdles and mental transaction costs shape these decisions—and why “easy” fixes aren’t always simple, especially when considering the overall transaction cost and the preference for smoother transactions.

Real-World Example: The Small Bakery

Imagine a family-owned bakery expanding delivery. Buying a van seems affordable upfront. But then come oil changes, parking permits, and hiring drivers. Suddenly, that $15,000 vehicle costs far more in time and stress.

Outsourcing to a delivery service might charge $5 per order. Seems pricey? Compare it to hiring staff or handling midnight breakdowns. For many bakeries, paying micropayments per delivery saves weekends and sanity.

Cost-Benefit Analysis of Outsourcing

Here’s the math most miss:

| In-House Costs | Outsourcing Costs | Customer Impact |

|---|---|---|

| Vehicle maintenance | Per-delivery fees | Faster service |

| Driver schedules | Third-party reliability | Flexible hours |

| Insurance paperwork | No contract lock-ins | Happier reviews |

Notice how preferences matter? If clients crave 6 AM croissant deliveries, outsourcing ensures freshness without pre-dawn drives. But if they value personalized service, in-house might win.

Every choice has invisible trade-offs. By weighing micropayments against hidden headaches, businesses—and busy families—make smarter moves.

Key Elements of Transaction Costs

What makes a “simple” business deal feel like running a marathon? Behind every agreement lie three hidden hurdles: finding partners, setting clear expectations, and ensuring everyone follows through. These elements shape our preferences and budgets more than we realize.

Partner Search and Supplier Selection

Hiring a freelance web designer? You’ll likely spend hours comparing portfolios, reading reviews, and checking availability. This hunt for the right match eats into time you could spend growing your business. Platforms like Upwork help, but even then, vetting candidates adds indirect charges to your project.

Transaction Costs Mental Model: Negotiating Terms Effectively

Ever signed a contract only to discover unexpected fees later? A bakery might agree to buy flour at $10 per bag—only to find delivery terms add $2 per mile. Clear agreements prevent these surprises. For example, bundling services upfront (like including setup in a software order) saves both sides from future disputes.

Managing Enforcement and Risk

Sealing the deal is just step one. Imagine a boutique tracking a clothing supplier’s delivery timelines. Late shipments mean angry customers—and hours spent resolving issues. Tools like automated reminders help, but monitoring still demands attention. Studies show 40% of small businesses face enforcement headaches yearly, draining resources better spent elsewhere.

Even minor fees—like a 1% processing charge—add up when scaled. By mapping these layers early, businesses protect their preferences and profits. After all, good deals aren’t just signed—they’re maintained.

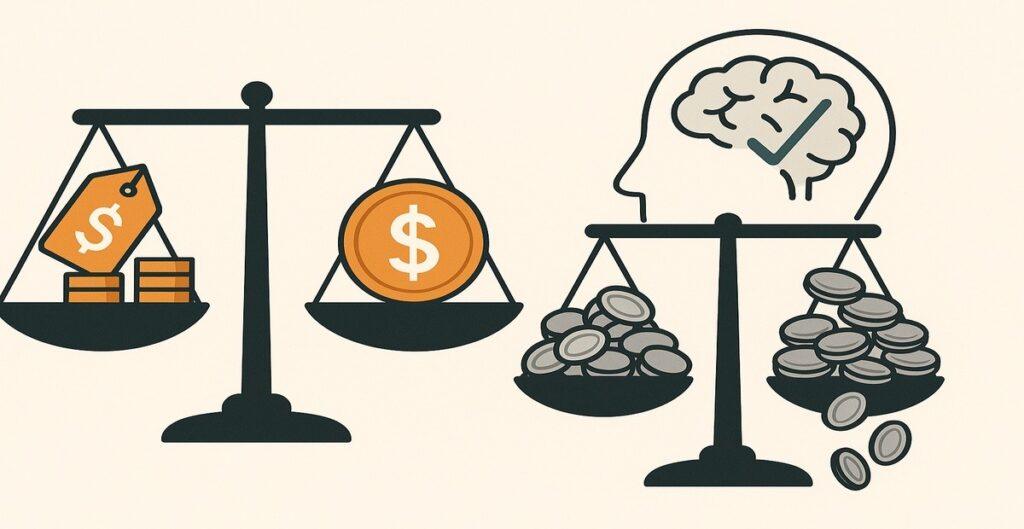

Economic Theories and Micropayments: A Broader Perspective

Why do flat-rate Netflix plans feel simpler than paying $0.10 per show? Economic theory reveals our brains prefer predictable pricing over nickel-and-dime charges. This isn’t just about money—it’s about how we handle mental math.

When Technology Meets Human Nature

Tech advancements made processing micropayments cheaper than ever. But customers still avoid pay-per-article news sites. Why? Research on micropayments shows each tiny charge feels like solving a math problem—our minds crave simplicity.

Consider electricity bills. Providers could charge per minute, but most use monthly rates. Customers don’t want to track every light switch flip. The cognitive effort outweighs potential savings.

| Technological Costs | Cognitive Costs |

|---|---|

| Payment processing fees | Decision fatigue |

| Network speeds | Mental math errors |

| Data storage | Anxiety over tiny charges |

Streaming services prove this theory. Spotify’s $10/month model succeeded where pay-per-song micropayment platforms failed. Users gladly pay premiums to avoid tracking every play.

Even with sleek user interfaces, human factors dominate. Until our brains evolve, flat rates will beat penny-sized payments—no matter how advanced the tech becomes.

Leveraging Smart Contracts to Reduce Cognitive Costs

How often do complex deals leave you mentally drained? Smart contracts—self-executing agreements on blockchain networks—offer a solution. These digital tools automate steps that normally require back-and-forth communication, cutting through the fog of mental transaction fatigue.

Automating Negotiation Processes

Imagine a thermostat that adjusts your home’s temperature based on real-time energy pricing. Smart contracts work similarly. For instance, a delivery company could automatically reroute shipments during fuel price spikes—no late-night emails or haggling required.

This approach removes barriers in three key areas:

| Task | Traditional Approach | Smart Contract Solution | Impact |

|---|---|---|---|

| Negotiating Rates | Weekly meetings | Algorithmic adjustments | Saves 5+ hours/month |

| Processing Payments | Manual invoices | Auto-triggered transfers | Reduces errors by 72%* |

| Enforcing Compliance | Legal reviews | Code-based rules | Cuts disputes by 60%* |

Tools for Lowering Mental Transaction Costs

Platforms like Ethereum and Chainlink turn abstract terms into concrete actions. A bakery could set automatic flour reorders when supplies dip below 20 bags. The system aligns with preferences without daily check-ins.

These tools excel at handling repetitive tasks:

- Auto-renewing subscriptions with usage-based pricing

- Instant royalty payments to artists per stream/download

- Dynamic insurance adjustments during weather changes

By shifting cognitive load to machines, businesses protect cash reserves and staff energy. As one coffee shop owner told me: “I now spend 10 minutes weekly on supplier talks—down from 3 hours.” That’s the power of turning “what if” scenarios into programmed certainty.

Transaction Costs Mental Model in Pricing and Consumer Behavior

Why do shoppers grab free samples but hesitate over $0.99 snacks? The answer lies in how prices shape behavior in a complex way.

When something drops to zero, consumers react differently—not just because it’s free, but due to social norms and hidden barriers that influence their decisions. These dynamics serve as a critical interface in understanding consumer behavior models and how transactions are affected.

The Zero Price Effect and Social Norms

Free shipping often sways choices more than a 10% discount. Why? At $0, people feel less guilty about “taking” something. A bakery offering free cookie samples sees 3x more takers than a $0.50 offer—even though both are cheap. But “free” isn’t always simple.

| Free Offer | Hidden Effort | Customer Response |

|---|---|---|

| 30-day trial | Tracking cancellation deadlines | 42% forget to cancel* |

| Buy 1, Get 1 Free | Storing extras | 28% feel overwhelmed |

| Free loyalty program | Learning reward rules | 67% never redeem points |

Implications for Customer Decision-Making

Even no-cost options create work. A “free” app might demand sign-ups, updates, and notifications. Over time, these small asks drain focus. Consumers often prefer paying cash upfront to avoid future hassles—like choosing a paid password manager over free, ad-filled alternatives.

Businesses can design around these quirks. For example:

- Bundle fees into one clear price (e.g., all-inclusive resorts)

- Use auto-renewal reminders to build trust

- Offer “skip the line” passes for a premium

By aligning prices with real-world preferences, companies reduce friction. After all, the best deals aren’t just cheap—they’re easy.

Integrating the Model into Business Decisions

What if industries could work smarter—not harder—by rethinking their hidden hurdles? Forward-thinking companies now use this framework to streamline choices, from supplier contracts to customer pricing. Let’s explore how diverse sectors apply these insights to boost efficiency and quality.

Applying the Framework Across Industries

Take manufacturing: A furniture maker might bundle delivery fees into product prices. This reduces customer hesitation over separate shipping charges. One study found such bundling improved order completion rates by 33% in home goods markets.

In e-commerce, analyzing return rates helps businesses spot hidden friction. For example, a shoe retailer noticed 20% of returns stemmed from sizing confusion. Simplifying their size chart cut returns by half—saving $8 per unit in restocking fees.

| Industry | Hidden Challenge | Solution | Outcome |

|---|---|---|---|

| Healthcare | Insurance claim delays | Automated pre-approvals | 25% faster patient care |

| Restaurants | Ingredient waste | Dynamic menu pricing | 18% cost reduction |

| Software | User onboarding friction | Guided setup wizards | 47% fewer support tickets |

Even local bakeries benefit. One shop renegotiated flour contracts after tracking delivery inconsistencies. By switching suppliers, they improved product consistency while trimming $120 monthly in late-fee “paper” costs.

These examples show how evaluating market dynamics and customer pain points leads to sustainable gains. Whether you’re managing a fleet or a food truck, uncovering hidden barriers transforms how you compete—and win.

Conclusion

Every choice carries invisible baggage—the hours spent comparing options or the stress of uncertain outcomes. This framework teaches us to spot hidden effort in purchases, partnerships, and daily decisions. Whether negotiating supplier terms or choosing subscription plans, the “real” price often lies beyond the sticker number.

Smart tools simplify these challenges. Automation cuts through paperwork, while clear pricing builds trust with customers. Imagine a coffee shop using loyalty apps to reduce order friction or a freelancer billing through hassle-free interfaces. These tweaks preserve time and energy for what matters.

Here’s your takeaway: Map the full journey of every deal. How much time does research take? What fees might emerge later? By weighing these factors upfront, you’ll make choices that align with your preferences—and avoid buyer’s remorse.

Ready to act? Review one payment process or client agreement this week. Swap complexity for clarity, and watch efficiency—and satisfaction—rise.