Imagine buying tickets to a concert months in advance. When the day arrives, you’re exhausted—but you go anyway because you already paid. That’s the sunk cost fallacy mental model in action: sticking with choices just because you’ve invested time, money, or effort, even when walking away makes more sense.

This bias tricks us into valuing past investments over current benefits. It happens everywhere—from finishing a bad meal to staying in unfulfilling jobs. Businesses often throw good money after bad to “save” failing projects. But here’s the catch: those costs are gone. They shouldn’t control your next move.

Why do we fall for this? Emotions like guilt or fear of waste cloud our judgment. We tell ourselves, “I’ve come this far,” or “It’ll get better.” Sound familiar? These thoughts keep us trapped in dead-end situations instead of cutting losses.

Recognizing this pattern helps you make clearer choices. Think of it like a mental reset button. By focusing on what’s ahead—not what’s behind—you avoid pouring energy into sunk costs. Ready to break free from this cycle?

Key Takeaways

- The sunk cost fallacy mental model makes us prioritize past investments over better options.

- It affects both personal decisions (like relationships) and business strategies.

- Emotions, not logic, often drive these irrational choices.

- Letting go of sunk costs frees you to pursue more rewarding paths.

- Practical awareness can prevent wasted time, money, and effort.

Defining the Sunk Cost Fallacy Mental Model

Ever sat through a movie you hated just because you bought the ticket? That’s the sunk cost fallacy mental model—a thinking trap where we cling to choices based on past investments, not future gains. Researchers like Kahneman and Thaler found this happens when we treat time, money, or effort as “recoverable” even when they’re gone forever.

Imagine ordering food that tastes awful. You eat it anyway to “get your money’s worth.” Here’s the problem: the meal’s cost is already gone. Finishing it won’t bring that cash back. Yet, our brains trick us into mixing past losses with current decisions.

This bias shows up in bigger ways too. People stay in unhappy relationships because “we’ve been together so long.” Companies keep funding doomed projects to justify earlier spending. Both cases ignore a simple truth: what’s spent can’t be undone. Smart choices require looking forward, not backward.

Why does this happen? Emotions like guilt or pride drown out logic. We fear feeling wasteful or admitting mistakes. But as Asana notes, recognizing this pattern helps you pause and ask: “Does sticking with this still serve me?” That shift is key to applying mental models effectively.

In short, the sunk cost fallacy mental model distorts judgment by tying us to irrecoverable investments. Breaking free means weighing options based on what’s ahead—not what’s already lost.

Real-Life Examples of The Sunk Cost Fallacy

Ever kept a gym membership you never use because you paid upfront? That’s a classic example of the sunk cost fallacy and irrational commitment in action. Let’s explore how this pattern shows up in daily choices and corporate boardrooms.

Everyday Scenarios and Common Dilemmas

You buy a book that bores you by chapter three. Do you finish it just because you’ve already invested $15? Many do. Relationships often follow this sunk cost fallacy script too—staying years in unhappy partnerships due to time sunk costs, not future potential.

Consider concert tickets. You feel awful on event day but force yourself to go. The money is gone whether you attend or not. Yet we treat attendance as “getting value” from the purchase, falling into the cost fallacy trap.

Business Investment Cases

Companies often double down on failing projects. The Concorde jet serves as a classic example of the sunk-cost fallacy in action. Governments kept funding it despite massive losses, trying to justify early investment. Result? Billions wasted on a plane airlines didn’t want.

Tech startups fall into similar traps. Founders pour more money into flawed apps because “we’ve spent two years building this.” Smart leaders ask: “Would we start this today?” If not, it’s time to pivot and rethink decision making strategies.

Ever pushed through a project just to avoid feeling wasteful? These patterns show how sunk costs cloud judgment due to cognitive bias. Recognizing them helps make choices based on what’s ahead—not what’s spent, providing valuable resources for better decision making.

Psychological of The Sunk Cost Fallacy

Ever held onto clothes that don’t fit, thinking “I’ll lose weight someday”? That’s your brain wrestling with hidden forces. Let’s unpack why we cling to fading hopes.

Loss Aversion and Framing Effects

Loss aversion makes $100 lost feel twice as painful as $100 gained. Studies by Kahneman show we’ll stick with bad investments to avoid admitting defeat. Picture working extra hours on a flawed project just because you’ve “put in so much energy” already.

Framing twists decisions too. Imagine choosing between “losing $500” or “saving $500”—same outcome, different reactions. Research reveals we’ll take bigger risks to avoid losses than to chase gains. It’s like refusing to sell a car needing constant repairs, fearing the “wasted” money more than future costs.

Unrealistic Optimism and Personal Responsibility

Ever stayed in a job hoping “things will improve” despite red flags? That’s unrealistic optimism—a cognitive bias convincing us tomorrow will fix today’s problems. We overestimate control, thinking effort alone can salvage sinking ships.

Guilt plays a role too. Admitting failure feels like betraying past efforts. Think of keeping a clunky sofa because “Grandma gave it to us.” Behavioral economics calls this personal responsibility bias: we double down to prove our initial choice wasn’t wrong.

These hidden psychological traps shape choices more than logic. Ever ignored red flags because quitting felt like “wasting energy”? Recognizing these patterns helps you pause and ask: “Am I choosing forward or just avoiding regret?”

Historical Background and Research

In the 1950s, economists noticed something odd. People kept investing in failing ventures despite clear losses. This pattern caught the eye of young psychologist Daniel Kahneman. Alongside Amos Tversky, he began exploring why humans make irrational choices.

Their research revealed a startling truth: we’re wired to chase lost causes. By the 1980s, Richard Thaler coined the term “sunk cost effects” through groundbreaking experiments. One study showed people would sit through bad movies just because they’d bought tickets—proving emotions often override logic.

Why does this happen? Time plays a sneaky role. The longer we’ve invested in something, the harder it feels to quit. Think of the Concorde jet project—governments kept funding it for decades despite mounting losses. Psychologists later found this “escalation of commitment” stems from our fear of looking wasteful.

Modern psychology studies use brain scans to explain this. When we abandon projects, the same neural areas light up as physical pain. This explains why walking away feels so uncomfortable—even when it’s the smart move.

Key findings from decades of research? First, past investments distort future decisions. Second, awareness alone helps people make better choices. Third, time-bound goals reduce irrational commitments. These insights now shape everything from stock trading to relationship counseling.

Today’s decision-making tools owe much to this psychology work. By understanding its roots, we gain power over hidden biases. After all, knowing history helps us rewrite our future choices—one rational step at a time.

Impact on Decisions and Behavioral Economics

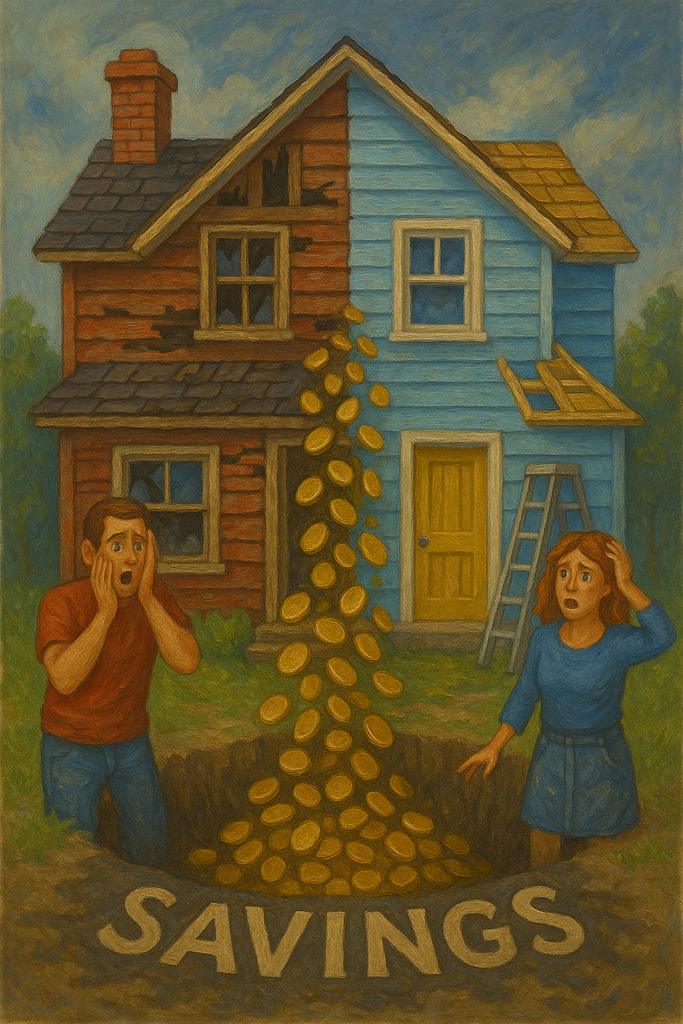

Ever renovated a house only to realize halfway that it’s draining your savings? You keep going because you’ve already torn down walls. This mindset—prioritizing past expenses over current reality—shapes choices in homes, boardrooms, and even governments.

Studies in behavioral economics reveal how people cling to failing plans. One experiment showed investors holding losing stocks 50% longer than logic dictated. Why? Admitting defeat felt worse than losing money.

Businesses often face this trap. A restaurant owner might keep a poorly-reviewed location open because “we’ve spent so much on renovations.” But every dollar spent is gone. Smart choices ask: “What benefits lie ahead?” not “What have we already lost?”

Daily life mirrors this pattern. Have you ever finished a tedious task just to avoid feeling wasteful? We misjudge future costs because our brains frame quitting as failure. This bias makes us less likely to pivot, even when evidence screams for change.

Resource allocation suffers too. Governments might fund outdated programs due to historical budgets rather than current needs. Families pour time into hobbies they no longer enjoy. The result? Wasted energy and missed opportunities.

Breaking free starts with one question: “If I started fresh today, would I choose this path?” It’s not easy—but it turns yesterday’s lessons into tomorrow’s wiser decisions.

Sunk Cost Fallacy in Business and Personal

In 1962, Britain and France shook hands on a supersonic dream—one that would cost billions and teach the world a costly lesson. This Concorde Fallacy shows how both companies and families chase lost causes, mistaking persistence for wisdom.

Case Study: The Concorde Fallacy

The Concorde jet project burned $1.3 billion over 27 years. Governments kept funding it despite zero airline orders after 1973. Why? Leaders feared admitting failure after already invested political capital. Sound familiar? It’s like finishing a Netflix show you hate—“But I’ve watched six episodes!”

Businesses repeat this pattern daily. A bakery owner renovates a slow store because “we’ve spent so much on equipment.” Families keep unused gym memberships for months. Both ignore the math: past spending won’t reverse tomorrow’s losses.

Research shows 72% of managers escalate failing projects to justify early investments. This mirrors personal choices—ever stayed in a hobby you disliked just because you bought gear? As studies on irrational decisions prove, we confuse dedication with desperation.

Here’s the fix: ask “Would I start this today?” If not, walk away. The Concorde’s creators didn’t—and taxpayers footed the bill. Your time and money deserve better than chasing yesterday’s mistakes.

Identifying the Signs of Irrational Investment

Ever kept watching a TV show you stopped liking—just to “see how it ends”? That nagging urge to finish what you started often signals the cost fallacy tendency. Let’s uncover the red flags that whisper, “It’s time to walk away.”

One clear example: pouring money into car repairs that cost more than the vehicle’s value. You tell yourself, “I’ve already replaced the transmission,” ignoring cheaper alternatives. Similarly, finishing a degree you no longer want because “three years can’t go to waste” traps you in a draining situation.

Watch for emotional energy drains. Feeling resentful while working on a project? Dreading meetings about a stalled initiative? These emotions hint you’re clinging to past choices, not future benefits. Like holding expired concert tickets “just in case,” it wastes mental bandwidth.

Misused resources scream louder. A freelancer might accept low-paying clients because “they’ve worked together for months.” But time spent here blocks better opportunities. Track where your hours and dollars flow—if they’re propping up fading returns, reassess.

Specific situation cues matter too. Do you dismiss friends who suggest quitting? Rationalize sticking with “just one more try”? These defenses often mask fear of loss. Ask: “If I found this opportunity today, would I take it?” If not, your answer’s clear.

Every choice needs fresh eyes. Are current efforts building toward something—or just repaying yesterday’s debts? Sometimes, the bravest move is pressing stop.

Strategies for Overcoming the Cost Fallacy

Ever kept working on a project long after it stopped making sense due to the sunk-cost fallacy? Breaking free starts with smart strategies that keep emotions in check, especially when you’ve already invested significant resources. Let’s explore two powerful methods and examples to help you focus on what matters—future results and your goals.

Data and The Sunk Cost Fallacy Mental Model

Numbers don’t lie. Track metrics like time spent, money earned, or satisfaction levels. For example, if a side hustle takes 20 hours weekly but earns $50, ask: “Is this worth my effort?” Tools like spreadsheets or apps can reveal patterns you might miss.

| Emotional Choice | Data-Driven Choice | Result |

|---|---|---|

| Keeping unused software subscriptions | Canceling after 3 months of zero logins | Saves $360/year |

| Continuing a stale marketing campaign | Pivoting when CTR drops below 1% | Boosts conversions by 22% |

Setting Clear Goals and a Regular Review Cadence

Define what success looks like upfront. Want to save $5,000? Break it into monthly goals. Review progress every 30 days—celebrate wins and cut losses fast. Asana’s guidelines suggest setting measurable targets to avoid “just because” commitments.

Try this three-step process:

- List current projects

- Rank them by future benefits

- Reallocate resources weekly

Remember: Every hour spent on fading ventures steals time from better opportunities. What could you achieve by redirecting that effort?

Cognitive Biases and Related Mental Traps

Have you ever kept an old phone plan despite better options? That’s your brain wrestling with hidden cognitive biases—mental shortcuts that twist decisions. These biases act like invisible puppet strings, pulling us toward irrational choices without us noticing.

Think of biases as faulty GPS systems. They guide us using outdated maps. For instance, the endowment effect makes us overvalue things we own. Ever refused to sell a gadget for $200 when you’d never pay that much to buy it? That’s bias in action—different from the sunk cost fallacy mental model, which traps us in past investments.

Here’s how they team up: Imagine sticking with a boring book club because “I’ve attended six meetings.” The status quo bias (preferring familiarity) joins the sunk cost fallacy tendency to create a double trap. Research shows these cognitive biases often overlap, like guests at a bad party nobody wants to leave.

Other sneaky examples include:

- Confirmation bias: Only noticing facts that support your current choice

- Escalation of commitment: Doubling down on failing plans to prove you’re “right”

Studies by Kahneman reveal how these distortions interact. People who fall for the sunk cost fallacy often score high on tests measuring loss aversion. It’s like mental gravity—the more you invest, the harder it feels to escape.

Spotting these patterns starts with simple checks. Ask: “Am I choosing this for future benefits or past reasons?” Awareness turns hidden traps into visible hurdles—and that’s half the battle won.

Avoiding The Sunk Cost Fallacy Trap

Stuck finishing a book you stopped enjoying three chapters in? We’ve all faced moments where past efforts cloud current choices. Here’s how to reset your compass and make decisions that serve your future self.

Evaluating Decisions Beyond Past Investments

Start by asking: “If I faced this choice today, would I begin it?” This simple question cuts through the “I’ve already spent…” mindset. Behavioral studies show people make clearer choices when they ignore loss fears and focus on what’s ahead.

Try these steps:

- Track how much time or money you’re currently investing weekly

- Compare those numbers to potential future gains

- Ask a friend: “Would you start this now?”

| Situation | Emotional Response | Better Approach |

|---|---|---|

| Staying in a draining job | “I’ve already worked here 5 years” | List skills gained vs. new opportunities |

| Keeping unused subscriptions | “But I paid for the whole year!” | Calculate monthly waste vs. yearly savings |

Notice how loss aversion often masquerades as loyalty? Break free by scheduling quarterly “life audits.” Review commitments like a CEO would—cut what doesn’t align with your current course.

Remember: Every minute spent on fading ventures steals time from better paths. What could your future self achieve if you redirected that energy today?

Conclusion

Ever finish a task just to check it off your list? That urge to “see things through” often blinds us to smarter choices. Our choices get tangled in past efforts—whether it’s sticking with outdated business plans or clinging to fading hobbies, a classic example of the sunk cost fallacy.

What’s spent can’t be recovered. Yet we keep pouring resources into dead ends, mistaking persistence for wisdom. Studies show this pattern thrives on emotional attachments—guilt, pride, or fear of admitting mistakes, which can often be linked to the psychology of the sunk cost.

Breaking free starts with one question: “Does this still serve my goals?” Whether managing investments or personal projects, focus on future benefits over sunk expenses. Track your decisions weekly. Celebrate when you redirect energy toward better paths, avoiding the cognitive bias of thinking, “I’ve already invested” in something.

Practical strategies help:

- Review commitments quarterly

- Use data to override emotional pulls

- Ask trusted friends for reality checks

Next time you feel stuck, pause. Could those hours or dollars create brighter outcomes elsewhere? Every choice is a fresh start—don’t let yesterday’s costs steer tomorrow’s journey.