Imagine predicting stock prices, weather patterns, or even traffic flow. These systems share one thing: unpredictable changes over time or space. This is where the stochastic processes mental model comes in. Think of it as a toolkit for understanding randomness in real-world events.

At its core, the Stochastic Processes mental model describes how random variables evolve. Picture flipping a coin repeatedly or tracking temperature fluctuations over time.

Each outcome depends on chance and the properties of stochastic processes, but patterns emerge when viewed collectively in space. For example, Brownian motion (like pollen moving in water) shows how tiny random steps create larger trends, illustrating the theory behind these processes.

Why does this matter? From finance to engineering, these concepts help us make smarter decisions in uncertain environments. The Wiener process models stock market behavior, while the Poisson process predicts rare events like system failures.

Even Markov processes—used in weather forecasting—simplify complex dependencies by focusing only on the current state and utilizing probability to understand variables.

Key Takeaways

- Stochastic processes analyze random events unfolding over time or space, providing a framework for understanding complex systems.

- They use collections of variables to model systems like stock markets or machine reliability, highlighting the importance of probability in these processes.

- Examples include Brownian motion for physics and Markov chains for predictions, showcasing the application of mathematical theory.

- Applications span finance, engineering, biology, and artificial intelligence, addressing various problems in different fields.

- The Stochastic Processes mental model helps quantify uncertainty in dynamic environments, allowing for better decision-making based on information and calculus.

Introduction to the Stochastic Processes Mental Model

Have you ever wondered how scientists predict unpredictable events? Think of a bouncing ball in a lottery machine or phone calls arriving at a switchboard.

These systems rely on random variables changing over time—the heart of what we call a stochastic process.

Definition and Key Concepts

At its simplest, this model tracks how randomness unfolds. Imagine flipping a coin daily for a year. Each flip is a random variable, and the sequence forms a “process.” Two elements define it:

- Index sets: Like timestamps in weather data or positions on a DNA strand.

- State space: Possible outcomes, such as “heads/tails” or temperature ranges.

For example, telephone networks use the Poisson process to manage call volumes. It’s all about spotting patterns in chaos.

Historical Background and Evolution

Louis Bachelier kickstarted this field in 1900 by modeling stock prices and contributing to the understanding of population dynamics through stochastic equations.

Later, Albert Einstein explained pollen movement in water (Brownian motion) using similar ideas, which are fundamental in various fields. By 1933, Andrei Kolmogorov turned these observations into rigorous math—like his consistency theorem that ensures processes behave predictably over time, linking random functions to specific outcomes.

Today, these tools power everything from Wi-Fi signal analysis to predicting storm paths, utilizing the Poisson process and Wiener process for accurate information modeling. Randomness isn’t just noise—it’s a language we’re learning to decode.

The Fundamentals of Randomness and Mental Models

Why do some events feel unpredictable even when we study them closely? The answer lies in how randomness shapes our world. Like raindrops hitting a sidewalk or customers entering a store, these patterns rely on random variables—values that change by chance.

The Role of Random Variables and Uncertainty

Think of random variables as building blocks for uncertainty. A gambler’s coin toss or daily temperature shifts all depend on these variables. They create two types of patterns:

| Example | Random Variable | Outcome |

|---|---|---|

| Bacterial growth | Number of cells | Unpredictable doubling |

| Gas molecules | Movement speed | Random collisions |

| Stock prices | Daily change | Market fluctuations |

Notice how each system has a range of possible outcomes. This “state space” defines what could happen next. For instance, weather models use probability to predict rain chances—not exact forecasts.

Real-world applications thrive on this approach. Traffic flow analysis uses time-based variables to reduce congestion. Even Wi-Fi signals rely on random noise patterns to transmit data reliably.

By embracing uncertainty, we build mental models that mirror life’s complexity. The key? Focus on probable outcomes, not guarantees.

Deep Dive into stochastic processes

How do experts turn chaos into order? Let’s break down two essential tools: index sets and state spaces. Think of them as the GPS coordinates guiding us through randomness.

Understanding Index Sets and State Spaces

Index sets mark when or where something happens. Like timestamps on weather data or mile markers on a highway. For example:

- Traffic lights changing every 90 seconds

- Heart rate measurements taken hourly

State spaces list all possible outcomes. Imagine a weather app showing “sunny,” “cloudy,” or “rainy.” These options form the system’s playbook of possibilities.

Exploring Random Functions and Sample Paths

Random functions act like unpredictable artists. They paint different patterns each time. Picture stock prices zigzagging on a chart—each unique path tells a story.

Brownian motion offers a classic example. Dust particles in water don’t move straight—they jitter randomly. Over time, these tiny movements create visible trends. This mirrors how foundational theories explain complex systems through simple rules.

Real-world applications shine here. Call centers use these concepts to predict busy hours. Wi-Fi routers manage data flow by analyzing signal patterns.

By mapping the could-be instead of the will-be, we make smarter choices in uncertain situations.

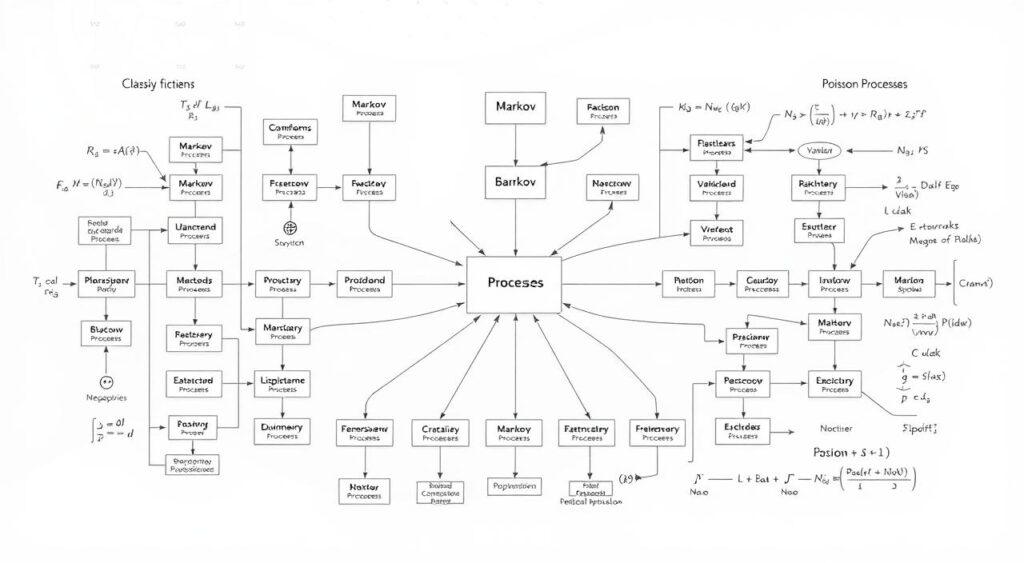

Classifications and Types of Stochastic Processes

Ever notice how some events feel like clockwork while others surprise us? This difference shapes how we categorize systems influenced by chance. Let’s explore two main approaches and three special types that power real-world predictions.

Snapshots vs. Live Streams

Discrete systems work like photo albums—you see moments frozen in time. Think of customers entering a store (1 person at 10 AM, 3 at 11 AM). Continuous systems flow like a river, tracking changes every millisecond. Stock prices updating live exemplify this.

Three Unique Patterns

Markov models focus on the present. Imagine predicting tomorrow’s weather using only today’s data—no history needed. Poisson systems count rare events, like how many cars pass a toll booth hourly. Wiener models handle smooth, unbroken changes—perfect for tracking bond prices over decades.

| Type | Key Trait | Real-World Use |

|---|---|---|

| Markov | Depends only on current state | Voice recognition software |

| Poisson | Counts random events in fixed time | Emergency room arrival forecasts |

| Wiener | Continuous, unpredictable motion | Financial risk modeling |

These categories help engineers build better traffic apps and economists model market risks. By understanding their unique properties, we turn overwhelming randomness into actionable insights.

Mathematical Properties and Theorems

What keeps casino profits steady despite random wins? The answer lies in probability distributions—the hidden rules governing chance. These mathematical tools show how outcomes spread across possibilities, like dice rolls clustering around seven.

Probability Distributions and Limit Laws

Two big ideas shape how we understand randomness. The Law of Large Numbers says averages stabilize over time. Flip a coin 1,000 times, and heads will likely land near 50%. The Central Limit Theorem reveals another pattern: even wild randomness forms a bell curve when scaled up.

| Concept | What It Does | Real-World Use |

|---|---|---|

| Law of Large Numbers | Predicts long-term averages | Insurance risk calculations |

| Central Limit Theorem | Explains normal distributions in chaos | Quality control in manufacturing |

Financial models rely heavily on these principles. Stock traders use limit laws to estimate price ranges, while banks assess loan defaults through probability curves. Ever noticed how weather apps show “70% chance of rain”? That’s distribution math in action.

These ideas form the foundation of probability theory. They turn scattered data into actionable insights. For instance, the randomness mental model helps us see patterns in everything from sports stats to election forecasts.

Why does this matter? Understanding distributions, such as the poisson process and brownian motion, lets us prepare for uncertainty—like knowing a “once-in-a-century flood” might come sooner than we think.

It’s not magic—just math lighting the way through complex functions and fields of probability. These concepts help us solve problems and assess the number of potential outcomes in any given case.

Constructing Stochastic Processes

Creating predictive models is like assembling a blueprint for chaos. How do mathematicians design systems that account for endless possibilities?

They use finite-dimensional distributions—the building blocks of randomness.

Consistency: The Glue Holding Predictions Together

Imagine tracking daily temperatures. Your Monday forecast says 75°F, and Tuesday’s says 80°F. If Wednesday’s prediction jumps to 32°F in July, something’s wrong. This is consistency in action—each prediction must align with previous ones.

Real-world example: Stock traders use this principle. Today’s price movements can’t contradict yesterday’s closing data. Systems break when distributions clash.

Kolmogorov’s Master Key

Think of this theorem as a puzzle guarantee. If all pieces (distributions) fit logically, the full picture exists—even if unseen. It’s why weather apps can show hourly forecasts without observing every cloud.

This math magic powers Wi-Fi routers. They handle data flow by assuming signals follow consistent patterns—even during Netflix marathons.

Three Practical Construction Tricks

1. Recursive conditioning: Like predicting traffic lights. Green now? Likely red soon.

2. Separability: Focus on key moments (noon stock prices vs. every millisecond).

3. Right-continuous paths: Ensure smooth transitions, like elevator floors lighting up sequentially.

These methods turn abstract math into working models. Next time you check the weather radar, remember—it’s built on probability legos that snap together perfectly.

Applications in Real-World Systems

How do everyday systems handle unpredictability? From Wall Street to weather radars, structured randomness shapes our world. Let’s explore how hidden patterns drive decisions in finance, nature, and technology.

Financial Models and Stock Market Analysis

Stock traders don’t guess—they model. The Black-Scholes equation uses random variables to price options, treating market shifts like wind patterns. Imagine predicting a hurricane’s path. Traders apply similar logic to estimate price ranges.

| Industry | Application | Example |

|---|---|---|

| Finance | Option pricing | Black-Scholes model |

| Ecology | Species migration | Sensor network analysis |

| Engineering | Signal optimization | 5G tower placement |

Weather Prediction and Ecological Studies

Ever notice weather apps getting smarter? They use time-based models to simulate storm movements. Ecologists apply similar tools to track endangered species. Sensors in forests collect population data, revealing hidden migration routes.

Engineering Breakthroughs

Your phone’s Wi-Fi relies on noise-filtering algorithms. Engineers use point process theory to place cell towers where signals overlap least. It’s like solving a puzzle where pieces move randomly—but the picture always comes together.

From predicting market crashes to saving coral reefs, these applications prove randomness isn’t chaos—it’s a roadmap waiting to be decoded. Next time you check the forecast, remember: math is whispering behind the clouds.

Advanced Concepts in Stochastic Calculus and Ergodic Theory

How does your phone predict traffic jams before they form? The answer lies in advanced math tools that turn randomness into actionable patterns. Let’s explore two powerful ideas used in everything from stock trading to weather apps.

Stochastic Integrals and Differential Equations

Think of stock prices as mountain trails—always changing, never predictable. Stochastic integrals help map these paths. Imagine tracking a hiker’s position every minute. Each step depends on terrain (trend) and loose rocks (randomness).

The Wiener process models this mix of order and chaos. Traders use it to estimate price ranges, while engineers predict equipment wear. Ever noticed how GPS apps adjust routes in real time? They’re solving similar equations on the fly.

Ergodic Principles and Spectral Analysis

Why do 30 days of weather data predict annual patterns? Ergodic theory shows that time averages often match space averages. Picture measuring rainfall: one sensor over a year equals 365 sensors on one day.

Spectral analysis breaks signals into simpler parts. Like separating ingredients in a smoothie. Wi-Fi routers use this to filter noise—ensuring your video calls stay clear even during storms.

These tools power modern life silently. From optimizing factory robots to modeling disease spread, they turn “random” into “manageable.” Ready to see hidden patterns everywhere?

Integrating the Mental Model into Decision-Making

What if your daily choices could harness the power of randomness? This mental model helps turn uncertainty into a strategic ally. Let’s explore how to apply these ideas in real-world scenarios.

Predictive Analysis and Problem-Solving Strategies

Ever noticed weather apps improve their rain predictions? They use time-based probability models similar to stock traders. Here’s how it works:

- Break problems into smaller steps (like hourly sales data)

- Assign probabilities to each possible outcome

- Update predictions as new information arrives

The Monte Carlo method, used in financial modeling, simulates thousands of scenarios to find likely results. It’s like testing every possible chess move before playing.

Case Studies and Practical Applications

A hospital reduced emergency wait times by modeling patient arrivals as random events. By analyzing historical data and using statistical techniques, they optimized staff schedules during peak hours.

In manufacturing, quality checks use probability thresholds to flag defects. If 3 out of 100 items fail, the system alerts managers—stopping issues before they escalate, a common application in stochastic processes.

These examples show how blending theory with practice creates smarter solutions. Whether managing investments or planning city traffic, this approach turns guesswork into calculated strategy, as discussed in various articles and books on the subject.

Conclusion

From weather apps to Wall Street, we’ve seen how randomness shapes our world. The Stochastic Processes mental model—built on time, space, and probability—helps us find order in chaos. Think of it as a flashlight in foggy terrain, revealing paths we couldn’t see before.

History shows progress. What began with stock price predictions now guides AI systems and emergency room staffing. Those random variables and state spaces? They’re not just math terms—they’re tools for making smarter choices when outcomes feel uncertain.

Ever wonder how traffic lights adjust to rush hour or why insurance models handle disasters? These real-world wins come from blending theory with action.

Like using Markov processes to simplify complex decisions or Poisson calculations to prepare for rare events.

Here’s the takeaway: Life’s unpredictability isn’t a barrier—it’s a puzzle waiting to be solved. Whether managing investments or planning city infrastructure, this approach turns “what if” into “here’s how.” Ready to see patterns where others see noise?