Have you ever wondered why your savings account gains don’t always match your purchasing power? That’s the Fisher Effect Mental Model. It’s a powerful economic concept that connects nominal interest rates, real interest rates, and inflation.

This idea, developed by economist Irving Fisher, helps us see through the “money illusion” and make smarter financial choices.

At its core, the model shows how lenders and borrowers adjust for inflation. Imagine a bank offers a 5% return on your deposit. If prices rise by 3% that year, your real gain is just 2%. Fisher’s equation—Nominal Interest Rate ≈ Real Interest Rate + Expected Inflation—reveals this hidden relationship. It’s like having X-ray vision for financial decisions!

Why does this matter? When inflation spikes, banks raise their advertised rates. But the Fisher Effect model reminds us to look beyond the surface numbers. A 7% loan might sound costly, but if inflation hits 4%, the true cost isn’t as scary as it seems.

From choosing mortgages to evaluating bonds, this mental model helps everyone. Retirees can protect their nest eggs. Young investors can spot real growth opportunities. Even policymakers use these insights to shape economic strategies.

Key Takeaways

- The Fishe Effect Mental Model reveals the hidden link between interest rates and inflation

- Helps distinguish between nominal gains and real purchasing power

- Essential for loan decisions, investments, and retirement planning

- Rooted in Irving Fisher’s groundbreaking economic research

- Applies to everyday choices like savings accounts and mortgages

Introduction to the Fisher Effect Mental Model

When banks advertise their rates, do you ever question what those numbers truly mean? This fundamental economic principle reveals why nominal interest rates often differ from what you actually earn.

It’s all about adjusting for rising prices over time, affecting both the real interest rate and the nominal interest. Understanding the Fisher Effect Mental Model is crucial for grasping how interest rates impact your financial decisions.

Definition and Key Concepts

At its simplest, this concept connects three critical pieces: advertised rates, inflation, and purchasing power. Let’s say your bank offers a 4% return on a savings account. If prices jump 2% that year, your real interest rate—the actual growth in buying power—is just 2%.

- Nominal rates: The percentage banks promise

- Real rates: What remains after inflation eats into gains

- Inflation expectations: How people anticipate price changes

Irving Fisher and His Economic Legacy

The economist behind this idea revolutionized how we view money’s value. Irving Fisher showed that markets naturally adjust rates to account for the inflation rate.

His 1930s research still guides modern finance—from setting mortgage terms to predicting bond yields, particularly in periods of increasing nominal interest rates.

Why does this matter today? Imagine locking in a 5-year loan at 6%. If inflation averages 3%, the true cost isn’t just the advertised nominal interest rate.

Fisher’s insights help us see through temporary price swings to make smarter long-term choices regarding interest rates.

The Fisher Effect Mental Model: The Basic Equation

What if you could decode bank rates like a pro? The secret lies in a simple formula that separates flashy numbers from real value. This equation acts as a decoder ring for financial decisions, showing how inflation reshapes what money can actually buy.

Breaking Down Nominal and Real Interest Rates

Let’s unpack the formula: (1 + Nominal Rate) = (1 + Real Rate) x (1 + Inflation). Here’s what each part means:

The nominal rate is what banks advertise—like a 5% savings account. The real rate is your true buying power after prices rise. If inflation hits 3%, that 5% becomes just 2% in actual growth.

Imagine borrowing $10,000 at 6% interest. If prices jump 4% annually, your real cost isn’t 6%—it’s closer to 2%. This math explains why “low rates” sometimes feel expensive and “high rates” can be bargains.

Why does this matter? Lenders bake expected price hikes into their offers. A 7% loan might look steep today, but if inflation surges, you could end up paying less in real terms. Savers need this insight too—a 3% CD loses value if milk and gas climb 5%.

Keep this formula handy when comparing financial products. It turns confusing percentages into clear pictures of profit or loss. Next time you see a rate, ask: “What’s left after inflation does its damage?”

Nominal vs. Real Interest Rates Explained

Why does your paycheck buy less each year? The answer lies in the hidden battle between nominal rates and real rates. Let’s say your bank offers 5% interest on savings. If milk prices jump 3%, your true gain shrinks to 2%—that’s your real return after inflation.

How Inflation Shapes Financial Returns

Think of nominal rates as sticker prices and real rates as what’s left in your wallet. A 4% CD sounds nice until groceries cost 5% more. Suddenly, you’re losing purchasing power despite “earning” interest. Banks know this—they adjust advertised rates based on inflation rate forecasts.

Here’s why it matters: When the Fed raises rates to cool prices (monetary policy), your car loan gets pricier. But if inflation outpaces those hikes, the real cost might stay manageable. Savers face the reverse—high nominal rates don’t help if prices soar faster.

Ever heard retirees talk about 1980s rates? Back then, 15% savings accounts fought 13% inflation. The real return? Just 2%. Today’s lower rates with mild inflation can sometimes deliver better actual growth. It’s not about the number—it’s what that number buys.

The Role of Inflation in Financial Decisions

Why do smart investors always ask about future price trends? It’s because expected inflation shapes every dollar decision. When people anticipate rising costs, they demand higher nominal interest rates to protect their buying power.

This invisible force quietly guides loans, savings, and even grocery budgets, affecting both nominal and real interest rates.

Fisher Effect Mental Model: Adjusting for Money Illusion

Money illusion tricks us into focusing on face-value numbers. A 5% raise feels great—until rent jumps 7%. Savvy planners cut through this fog by calculating nominal real differences. They ask: “Will this salary keep pace with next year’s gas prices?”

Take homebuyers eyeing mortgages. If inflation predictions hit 4%, a 6% fixed-rate loan becomes attractive. Why? The real rate drops to 2% as prices rise. Retirees use similar logic, choosing investments that outpace projected cost hikes.

Irving Fisher’s work teaches us to bake forecasts into choices. When businesses set prices or workers negotiate wages, they’re applying his principles. His equation isn’t just math—it’s a mindset shift. By seeing beyond today’s numbers, we build futures that inflation can’t erode.

Next time you see a “great rate,” pause. Ask: “What’s the story after expected inflation?” That simple question could save thousands in hidden costs—or uncover real growth opportunities.

Fisher Effect Mental Model Applications

Everyday financial decisions—from retirement accounts to coffee prices—are shaped by an invisible force. Understanding this relationship helps investors, businesses, and policymakers navigate changing economies with confidence.

Investment Strategies and Bond Returns

Smart money managers subtract inflation from advertised yields. A bond paying 6% seems attractive, but with 3% price hikes, your real return drops to 3%. This math explains why retirees often prefer inflation-protected securities.

Long-term investors use this economic theory to compare assets. Gold might offer 0% interest, but if inflation averages 4%, it could outperform a 3% savings account. The key? Always ask: “What survives after prices rise?”

Business Pricing and Planning in Changing Economies

Local bakeries and tech giants face the same challenge. When flour costs jump 10%, that muffin price needs to reflect future rate changes. Companies bake inflation forecasts into contracts and wage agreements.

Major retailers like Walmart adjust inventory orders based on central bank signals. If policymakers hint at rate hikes, businesses stock up before borrowing costs climb. This dance between expectations and action keeps shelves stocked—and profits intact.

From Main Street to Wall Street, Irving’s insights remain vital. Whether choosing a mortgage or pricing products, peeling back the inflation layer reveals smarter choices. After all, what good is a 5% raise if eggs cost 8% more next year?

Impact on Monetary Policy and Central Banking

Picture this: your local coffee shop suddenly charges double for lattes. How do big banks react? Central institutions like the Federal Reserve use a simple rulebook to balance price hikes and economic growth. Their secret weapon? Adjusting interest rates based on where they think inflation is headed.

How Central Banks Respond to Inflation Expectations

When bread prices creep up, policymakers don’t panic—they calculate. If experts predict 4% inflation, banks might lift rates by 5%. Why the extra bump? They’re guarding your real returns—the buying power left after prices rise. This dance keeps economies from overheating or freezing.

Take your car loan as an example. If the Fed raises its target rate to 6%, your bank follows suit. But here’s the twist: those higher rates make borrowing costlier, slowing spending. As demand cools, price jumps often ease too. It’s like tapping the brakes before a curve.

A recent London School of Economics study shows why stability matters. When real returns stay predictable, businesses invest and families plan budgets confidently. Wild swings? They create chaos—like 1970s stagflation or 2008’s crash.

Your wallet feels these moves daily. Fixed-rate mortgages get pricier when banks hike interest. Savings accounts might pay more, but only if gains outpace rising costs. Next time news anchors shout about rate changes, ask: “What’s this mean for my grocery bill next year?” That’s how you see through the noise.

The Fisher Effect in Currency Markets and International Finance

Currency traders have a secret weapon to predict exchange rate swings—and it’s simpler than you think. When nations set different interest rates, their money values shift in predictable patterns. This global dance hinges on one key factor: inflation gaps between countries.

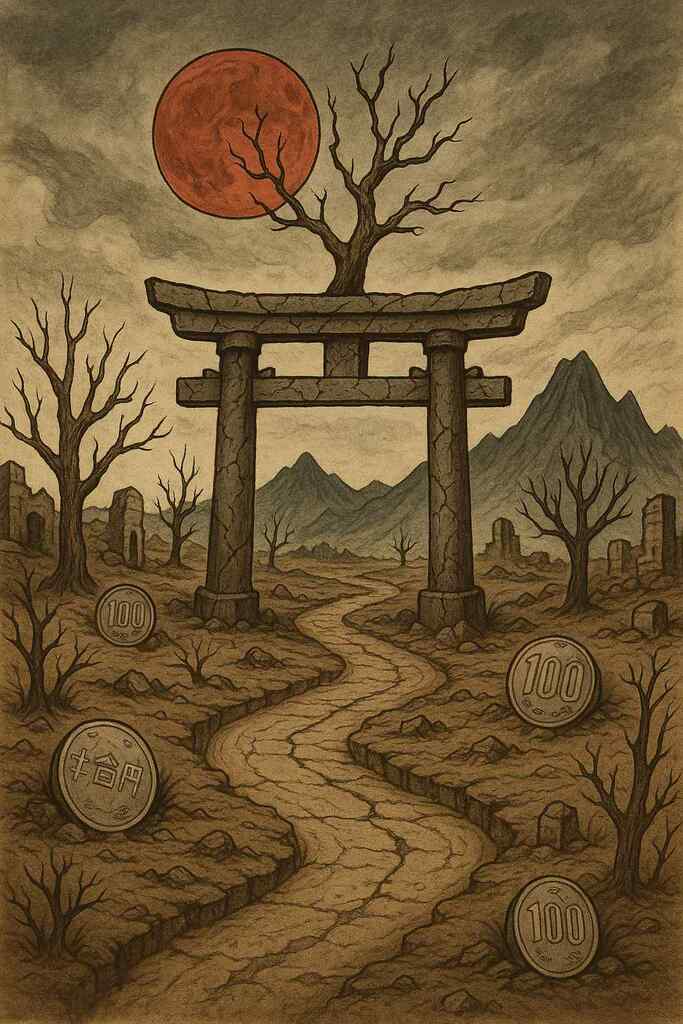

The International Fisher Effect Mental Model and Exchange Rates

Imagine two countries: one offers 6% savings rates with 4% inflation, another gives 3% returns with 1% price hikes. The first nation’s real rate is 2%, the second’s is 2% too. Their currencies should balance out over time. That’s the core idea behind this global financial rule.

Central banks watch these differences closely. If Mexico’s bank raises rates to fight inflation while Canada keeps rates steady, traders anticipate the peso strengthening against the loonie. They use the equation (Nominal Rate – Inflation = Real Rate) to spot mispriced currencies.

| Country | Nominal Rate | Inflation | Currency Impact |

|---|---|---|---|

| United States | 5.5% | 3% | Gradual dollar rise |

| Japan | 0.1% | 2.5% | Yen depreciation |

| Brazil | 13.75% | 8% | Real stabilizes |

Why does this matter for travelers or importers? If you’re buying euros for a Paris trip next year, check the Eurozone’s policy moves first. Higher expected inflation there means your dollars might stretch further later—even if euro rates look low today.

Money flows where real returns shine brightest. When Australia’s mining boom pushed rates up in 2011, global investors flocked to AUD bonds. This demand lifted the currency 30% in two years. Smart moves start with comparing real rates—not just flashy percentages.

Money Supply vs Interest Rates

Imagine your local bank suddenly offers lower loan rates—what’s really happening behind the scenes? When money supply grows, banks have more cash to lend. This flood of available funds pushes interest rates down, like a supermarket slashing prices during a surplus.

Dynamic Shifts in Loanable Funds

What’s the Fisher Effect on currency marketsReal-world example? During the 2008 crisis, the Fed pumped money into banks. Mortgage rates plunged from 6% to 3.5% in four years. Homebuyers rushed in—demand skyrocketed as supply expanded. By 2022, reversed policies saw rates double again.

Time plays a hidden role here. Quick money injections cause sharp rate drops. Gradual changes let markets adjust smoothly. Next time you see “rate specials” at banks, ask: “Is this a temporary surplus or a lasting shift?” The answer could save thousands on your next loan.

Examples of the Fisher Effect Mental Model in Action

Let’s explore three real-life moments where invisible economic forces reshaped outcomes. These stories show why peeling back the inflation layer matters for your wallet.

Case Studies from Real-World Scenarios

1. The 1980s Savings Account Surprise

When U.S. banks offered 12% interest in 1981, savers cheered. But with inflation at 14%, their real returns were negative. Those who spent gains quickly learned a lesson: high nominal rates don’t guarantee power over prices.

2. 2022’s I-Bond Boom

Treasury bonds paying 9.62% flew off shelves last year. Why? Savers knew inflation hit 8.5%—their real return stayed positive. This stampede confirmed how people chase changes in real value, not just big numbers.

3. Coffee Shop Price Wars

A Seattle café raised latte prices 20% in 2023. Regulars grumbled until they saw the math: milk costs jumped 30%. By adjusting for supply changes, the business preserved its profit power without losing customers.

These examples teach us to ask two questions: “What’s the inflation-adjusted truth?” and “How will tomorrow’s prices affect today’s choices?” Whether managing a retirement account or pricing products, the principle holds—numbers lie until you subtract rising costs.

Next time you see a flashy rate, pause. Could hidden inflation turn that 5% account into a 2% real gain? Your morning coffee ritual might just hold the answer.

Limitations and Criticisms of the Fisher Effect

What happens when textbook theories meet real-world chaos? While powerful for long-term planning, this economic principle stumbles in turbulent times. Short-term market shocks and unexpected crises often defy its predictions.

When Predictions Meet Unpredictable Markets

Consider 2008’s financial crisis. Banks kept rates low despite soaring inflation fears. The theory suggested higher returns to match price hikes—but panic overrode logic. Investors flocked to cash, creating a liquidity trap that broke traditional rules.

Japan’s “Lost Decade” offers another lesson. Near-zero rates and deflation lasted years, contradicting the economy’s expected behavior. As economist Paul Krugman noted: “Models assume rational markets. Reality? Sometimes pure survival instinct wins.”

| Scenario | Predicted Outcome | Actual Result |

|---|---|---|

| 2020 Pandemic | Rates rise with inflation | Central banks cut rates to 0% |

| 2015 Oil Crash | Deflation adjusts rates | Global rates stayed flat |

| 1997 Asian Crisis | Currency stabilization | Massive rate volatility |

Why does this gap matter? Your retirement return calculations might miss sudden economy shifts. A 5-year CD at 4% sounds safe—unless a banking crisis hits next year. These exceptions remind us: no theory perfectly captures human behavior’s wild card.

Does this mean the concept is useless? Hardly. But smart planners use it as one tool among many. Like checking both weather apps and the sky before a picnic, blending models with real-time data builds financial umbrellas for stormy markets.

Conclusion

The Fisher Effect mental model, first mapped by pioneering economist Irving Fisher , helps decode the hidden dance between interest rates and purchasing power. By separating nominal gains from real value, it reveals why a 5% loan might cost less than a 3% offer during inflationary periods.

From choosing mortgages to setting national policies, this framework remains vital. Consumers planning big purchases can better compare loan terms, especially when considering the impact of nominal interest rates on their financial decisions.

Businesses adjust pricing strategies as supply costs shift, taking into account the real interest rate to maintain profitability. Even central banks use these insights to maintain economic order.

While no tool predicts every market twist, Fisher’s equation offers a sturdy foundation. Unexpected events—like pandemics or tech breakthroughs—can disrupt the balance.

Yet understanding core relationships, including the difference between nominal real interest and actual purchasing power, helps people navigate uncertainty. Want to stay ahead? Always ask: “What’s left after inflation takes its cut?”

Three steps to apply this today:

- Check inflation forecasts before locking in rates, considering the nominal interest rate

- Compare investments using real return calculations based on current nominal interest rates

- Revisit long-term plans when price trends shift, factoring in the real interest rate

Whether you’re saving for retirement or running a business, keep this tool handy. After all, what good is a “great deal” if rising costs erase its value tomorrow?