Why do some companies thrive as they grow while others stumble? That’s the economies (and diseconomies) of scale mental model. The answer often lies in understanding how size impacts costs and efficiency in production. When firms expand, they can unlock savings through bulk purchasing or streamlined processes, illustrating the advantages of economies of scale.

But sometimes, getting bigger leads to chaos—like overcrowded factories or communication breakdowns, which can result in diseconomies of scale.

This mental model explains why scaling up doesn’t always mean better results. For instance, adding more machines might boost output initially. But if space becomes cramped, productivity drops, leading to higher per-unit costs. Similarly, hiring more employees without clear roles can create confusion instead of progress.

Think of it like a bakery: buying flour in bulk lowers costs per loaf (a win!). But if the kitchen gets too crowded, bakers bump into each other, slowing everything down. This balance between growth and efficiency shapes industries from tech to manufacturing, highlighting the importance of understanding both internal and external economies of scale.

Later, we’ll explore how factors like management styles and supply chains influence these patterns. Want to dive deeper? Check out the article on mental models in business strategy.

Key Takeaways

- Growing a business can lower costs per item but may also create new challenges in managing economies of scale

- Efficiency gains often come from bulk buying or specialized equipment, illustrating internal economies of scale

- Overexpansion leads to issues like wasted time and resources, highlighting the risk of diseconomies of scale

- Every industry has a “sweet spot” for optimal size and production efficiency

- External factors like supplier networks impact growth success in the market, influencing the economies of scale

Introduction to Scale Economics

Imagine a world where making more of something actually makes each item cheaper. That’s the heart of scale economics – a concept that reshaped industries during the Industrial Revolution. Factories discovered that producing higher output spread their fixed costs (like machinery) across more goods, shrinking the per-unit cost.

Think about your favorite coffee shop. When they buy beans in bulk, their cost per unit drops. More cups sold means each latte carries less overhead. But this only works if market demand supports the increased production. If they brew 200 lattes daily but only sell 50, those savings vanish due to the risk of diseconomies of scale.

What factors determine success? Efficient processes matter. A bakery using automated mixers can handle bigger orders without hiring extra labor. Supply chain relationships also play a role – reliable flour suppliers enable consistent production runs, contributing to internal economies of scale.

Ever wonder how big-box stores offer lower prices than mom-and-pop shops? Their size lets them negotiate better deals with suppliers. But growth isn’t always smooth. A local business doubling its menu might struggle with kitchen space or ingredient waste.

How does your go-to pizza place keep prices steady while expanding? They’ve likely found their efficiency sweet spot. Next, we’ll explore how technology and management styles shape these patterns even further.

Understanding Economies (and Diseconomies) of Scale

Have you ever noticed how some businesses get better as they grow, while others start to falter? The secret lies in balancing size and efficiency to achieve economies of scale. Let’s break down why bigger isn’t always better – and when it actually is.

What Are Economies of Scale?

When companies grow smartly, they often cut costs per item and achieve significant economies of scale. Imagine a toy factory buying plastic in bulk – their material costs drop with each truckload, demonstrating the benefits of internal economies of scale. Specialized machines speed up production, while experienced workers master complex tasks. These internal efficiencies create savings.

External factors help too. Local governments might offer tax breaks to large employers, enhancing external economies of scale. Suppliers could give discounts for consistent orders. But there’s a limit. Ever seen a packed restaurant kitchen at dinner rush? That’s where diseconomies of scale come into play, making things get tricky.

What Are Diseconomies of Scale?

Growth turns sour when resource limits kick in. Picture a growing delivery company: more trucks mean more maintenance headaches. Drivers wait longer at crowded warehouses. Managers struggle to track 100+ employees. These hidden costs eat into profits and can lead to diseconomies of scale. In this context, the cost per unit increases as the firm grows.

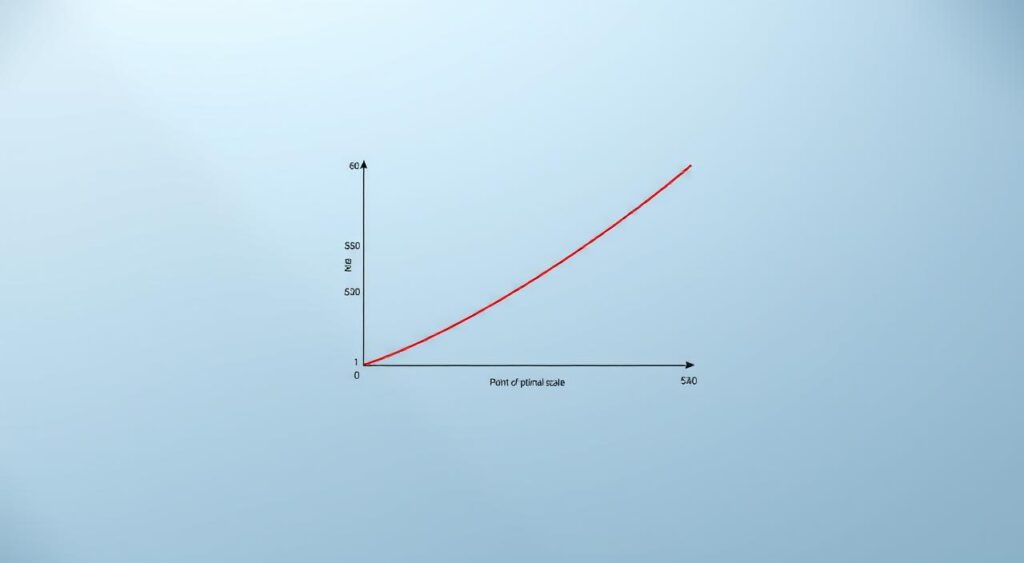

The breaking point often comes suddenly. A bakery adding a third oven might hit space limits. Dough mixes pile up, workers bump elbows, and bread burns. At this Q* moment, each new loaf costs more than the last, illustrating how economies of scale can turn into diseconomies as the size of production increases.

| Factor | Economies of Scale | Diseconomies of Scale |

|---|---|---|

| Production Volume | Lowers costs up to optimal level | Increases costs beyond capacity |

| Communication | Clear processes in mid-sized teams | Delays in large organizations |

| Supply Chain | Bulk discounts from suppliers | Storage costs for excess materials |

Does your favorite local business walk this tightrope? Maybe their coffee shop expanded just enough to add seating, but not so much that baristas get overwhelmed. Finding that sweet spot makes all the difference.

The Mental Model for Business Growth and Efficiency

Growth often feels like a race—but what if winning means knowing when to slow down? Smart leaders use a three-part framework to balance expansion with smart resource use in their firm.

It starts with measuring how each growth decision affects costs, quality, and team coordination, considering both economies of scale and diseconomies of scale that can occur as production increases.

Key Principles Behind the Mental Model

Process optimization sits at the core. A tech startup might automate customer service to handle more users without hiring extra staff. Bulk material orders cut per-unit costs, like a furniture maker saving 15% on lumber purchases. But these gains only matter if systems can handle higher output without breaking, especially in the context of economies of scale.

Targeted management makes this work. Imagine a retailer using sales data to decide which stores to expand. They avoid overloading locations that already struggle with inventory space. What happens when a company grows too fast? Orders pile up, delivery times slip, and customer trust erodes, leading to potential diseconomies of scale.

Strategic Implications for Companies

The best firms treat growth like adjusting a thermostat—not slamming the gas pedal. A car manufacturer might add night shifts to boost production without overcrowding the factory floor. They track metrics like defect rates and employee turnover to spot trouble early, which can help avoid potential diseconomies scale.

Training programs help teams adapt to new tools or workflows. A bakery chain teaching managers to optimize shift schedules avoids wasted labor hours and enhances internal economies scale. How do you recognize when to pivot? If costs rise faster than sales for three straight quarters, it’s time to rethink your strategy to maintain economies scale.

Internal and External Drivers of Scale

What separates companies that grow smoothly from those that hit roadblocks? The answer often lies in balancing internal choices and outside forces that affect their economies scale. Let’s explore how decisions inside the company and shifts in the wider world shape growth success, impacting production, cost, and overall scale.

Internal Factors: Management, Technology, and Processes

Smart leaders know growth starts at home. A clothing brand might use AI to predict fashion trends, cutting wasted fabric. Tight processes let them ship orders faster without adding staff. Good management keeps teams aligned – imagine a warehouse where pickers and packers move like clockwork, maximizing internal economies scale and reducing costs.

Upgraded tech often unlocks hidden capacity for production. A solar panel maker automating assembly lines could double output without expanding factories, demonstrating the advantages of economies scale. But tools alone aren’t enough. Training programs help workers master new systems, turning resources investments into real gains, increasing the firm’s ability to meet demand.

External Factors: Market Influence and Industry Trends

Outside forces push companies to adapt or stall. When cities offer tax breaks for green businesses, eco-friendly manufacturers thrive. A booming market for electric cars might lead battery makers to build bigger plants – if they can secure rare metals.

Ever notice how tech hubs attract skilled labor? Silicon Valley’s talent pool lets startups scale rapidly. But watch out for shifting factors like trade policies. A toy company relying on overseas supply chains might scramble if tariffs rise.

Take Tesla’s gigafactories. They combine advanced robotics (internal) with government incentives for clean energy (external). How does your favorite brand juggle these pressures? Comparative advantage models suggest focusing on what you do best while adapting to the world’s rhythm.

Impacts on Production, Costs, and Market Dynamics

Ever wonder why making more goods can actually make each piece cheaper? It’s all about spreading fixed expenses like rent or equipment across more units, illustrating the concept of economies of scale. This magic happens when businesses boost output without major new investments.

Economies (and Diseconomies) of Scale

Let’s break down average costs – the total expense divided by items made. When a factory makes 1,000 widgets instead of 100, the cost per widget drops due to the benefits of economies of scale. Why? Machines run longer, workers gain speed, and bulk material deals kick in, illustrating the concept of internal economies of scale.

Smart upgrades keep this rolling. A chemical plant using wider pipes moves four times more material for double the price, showcasing how external economies can enhance production. Workers stay focused because processes stay smooth. But push too hard, and diseconomies of scale such as storage costs or rushed quality checks erase gains.

| Cost Reducers | Cost Boosters |

|---|---|

| Bulk material purchases | Overtime pay for staff |

| Automated quality checks | Excess warehouse space |

| Employee cross-training | Last-minute shipping fees |

Take a bakery streamlining its bread line. After adding a dough divider, they make 200 loaves hourly instead of 120, showcasing how economies of scale can lead to significant production increases. Flour costs drop 18% per loaf thanks to bigger orders, illustrating the advantages of internal economies of scale.

Workers master their stations, cutting mistakes by half. But when orders hit 300/hour? The oven can’t keep up – burnt crusts appear, demonstrating the potential for diseconomies of scale when demand exceeds the firm’s capacity.

Want to see this in action? Investopedia’s graphs show how average costs dip then rise. How could smarter supply chain choices help your operation?

Navigating Risks and Overcoming Growth Challenges

How do successful companies avoid collapse when expanding? The answer lies in spotting trouble early and adjusting course. This involves a proactive approach to management that emphasizes continuous monitoring of key performance indicators and an agile response to emerging challenges.

Watch for these red flags that growth is backfiring in the context of economies of scale and the challenges of diseconomies of scale. Common indicators include increasing operational costs, delays in production, and diminishing returns on new investments.

Companies must remain vigilant, ensuring that their expansion strategies are sustainable and that they do not overextend their resources or capabilities. This is particularly important in industries where the size of the firm can significantly impact production costs and the overall economics of goods and services.

Warning Lights Every Leader Should Know

Rising per-unit expenses often signal trouble in the context of economies scale. If your cost per item creeps upward despite higher output, efficiency is slipping. Communication breakdowns between departments create delays. Workers might start competing for limited resources like machinery or storage space, leading to diseconomies scale.

Productivity plateaus are another clue in the economics of production. When adding staff or equipment stops boosting output, you’ve hit capacity limits. Example: A packaging plant added three new machines but saw delays. Why? Loading docks couldn’t handle the extra shipments, affecting the firm’s ability to meet demand.

Smart Fixes for Scaling Struggles

Conduct regular process audits. A furniture maker reduced errors by 40% after mapping workflow bottlenecks. Decentralize decision-making – let warehouse teams adjust schedules based on real-time demand.

| Problem | Solution |

|---|---|

| Overcrowded facilities | Split operations across multiple locations |

| Missed deadlines | Implement priority tracking systems |

| Inventory pileups | Adopt just-in-time delivery partnerships |

Track when average cost reductions stop. That’s your expansion boundary. One bakery chain found adding stores beyond 25 locations raised costs 12% due to distribution challenges. What systems does your firm use to balance growth with stability and manage economies of scale versus diseconomies of scale?

Conclusion

Finding the right size for your business feels like adjusting a backpack before a hike—too light and you’re unprepared, too heavy and you’ll stumble. Growth creates opportunities to lower cost per unit through smarter processes or bulk deals.

But every industry has a tipping point where adding more machines or workers starts creating chaos instead of value, illustrating the concept of economies of scale.

Internal choices like training programs and tech upgrades matter, but so do outside factors like supplier networks. Remember how splitting operations into smaller teams helped some factories avoid bottlenecks? That’s the power of knowing when scale occurs as an advantage versus a burden, especially in the context of external economies.

How will you spot your breaking point? Track when higher output stops cutting costs. Use tools like process audits and team feedback loops to analyze internal economies of scale. The goal isn’t endless expansion—it’s building a business that bends without breaking.

Growth isn’t a race. It’s a series of smart adjustments. What’s one change you’ll make this quarter to balance efficiency with ambition in your firm and ensure you’re maximizing your production capabilities?