It helps keep finances clear and honest. It also helps make better choices, no matter the technology.

Luca Pacioli: The Father of Modern Accounting

Portrait of Luca Pacioli, often credited as the “Father of Accounting”

While Luca Pacioli didn’t invent the double entry system, he played a crucial role in its formalization and widespread adoption. Born in 1447 in Sansepolcro, Tuscany, Pacioli was a Franciscan friar and mathematician who documented the double-entry bookkeeping method in his 1494 work “Summa de Arithmetica, Geometria, Proportioni et Proportionalita”, (The Collected Knowledge of Arithmetic, Geometry, Proportion, and Proportionality).

Pacioli’s book contained a section titled “Particularis de Computis et Scripturis” (Details of Calculation and Recording), which provided the first published description of the double-entry bookkeeping system that Venetian merchants had been using.

His work didn’t invent the practice but rather codified and explained the methods already in use by successful Italian merchants.

Pacioli’s Key Contributions

- Double entry system: Systematically documented existing double-entry practices

- Explained the purpose and methodology of maintaining journals and ledgers

- Outlined the year-end closing procedures and trial balance concept

- Demonstrated how the system could verify mathematical accuracy

- Established a framework that has remained fundamentally unchanged for over 500 years

Pacioli’s work spread throughout Europe as the printing press made books more accessible, helping to standardize accounting practices across different regions. His systematic approach to documenting every financial transaction earned him recognition as the “Father of Accounting”.

Though he himself acknowledged that he was documenting existing methods rather than inventing new ones, including the double-entry accounting method.

The Origins of Double-Entry Bookkeeping Before Pacioli

While Pacioli formalized the double entry system in 1494, the practice had already been evolving for centuries.

Archaeological and historical evidence suggests that various forms of double-entry accounting, including methods for tracking accounts receivable and managing assets liabilities, existed long before Pacioli’s documentation of financial transactions.

Early accounting records showing primitive double-entry methods

Ancient Roots of Double-Entry Practices

The earliest traces of double-entry concepts can be found in several ancient civilizations:

Mesopotamian Influence

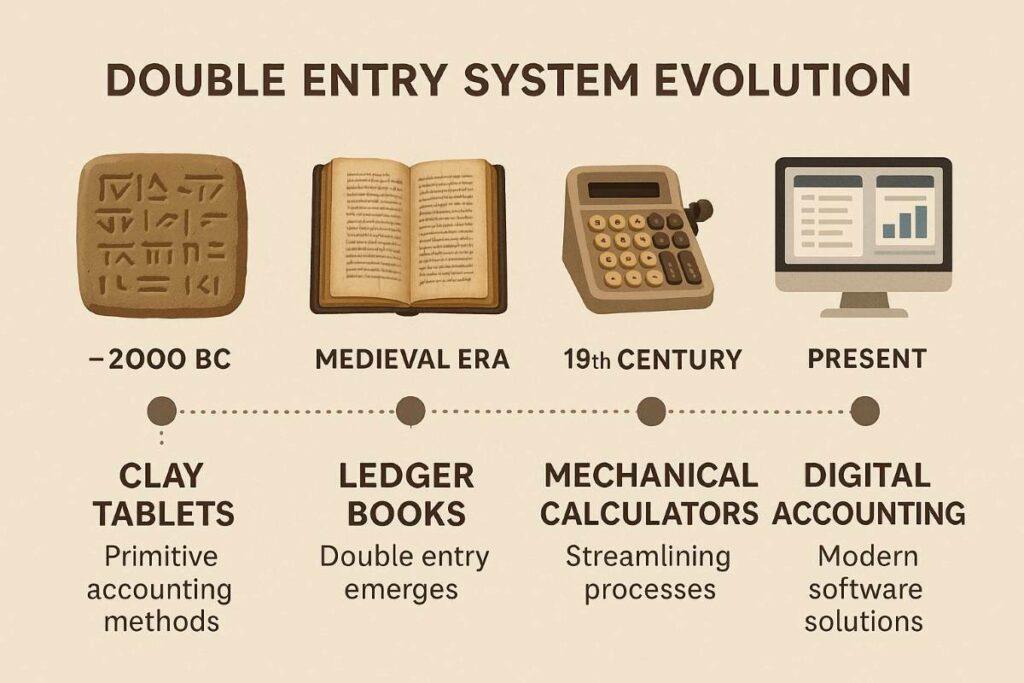

As early as 2000 BCE, Mesopotamian merchants used clay tablets to record transactions. While not true double-entry, these records showed an understanding of assets and liabilities that would later evolve into more sophisticated systems.

Ancient Roman Accounting

Roman households maintained an “adversaria” (daybook) and “codex accepti et expensi” (receipts and payments). This two-book system represented an early step toward the dual-aspect concept central to double-entry accounting.

Medieval Development

The double entry system as we recognize it today began taking shape during the commercial revolution of medieval Italy:

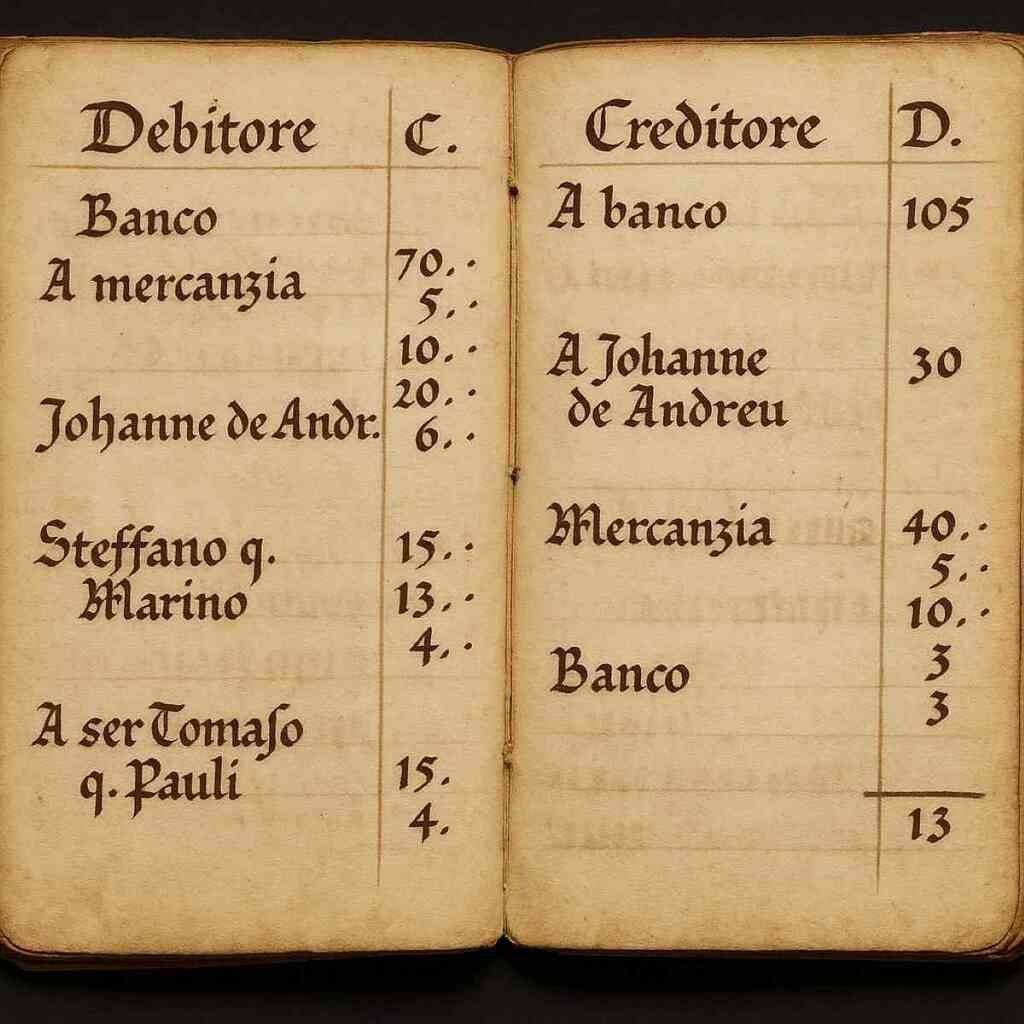

13th century Italian merchant ledger showing early double-entry methods

- Genoa (1340): The earliest known complete double-entry records come from the Genoese city government, predating Pacioli by over 150 years.

- Florence and Venice (13th-14th centuries): Italian merchant houses developed sophisticated accounting systems to track their far-reaching commercial empires.

- Islamic World: Some scholars suggest that Islamic merchants may have influenced Italian accounting practices through Mediterranean trade networks.

By the time Pacioli published his work, the double entry system had already been refined through centuries of practical application by merchants who needed reliable methods to track complex business operations spanning multiple currencies, partners, and locations.

Core Components of the Double Entry System

Understanding the fundamental principles of double-entry accounting reveals why this system has endured for centuries. At its core, the double entry system is built on several key components, including the management of different accounts, that work together to create a complete financial picture.

This includes the relationship between asset accounts and liabilities, which is essential for maintaining accurate inventory credit records.

The Accounting Equation

The foundation of double-entry bookkeeping is the accounting equation:

Assets = Liabilities + Equity

This equation must always remain in balance. Every transaction affects at least two accounts in a way that maintains this equilibrium. This mathematical balance serves as a built-in error detection system and provides a complete view of a company’s financial position.

Visual representation of the accounting equation in the double entry system

This equation doesn’t just ensure balance—it creates a feedback loop. Just like in systems thinking, one change affects others. The Double Entry System acts as a built-in correction mechanism.

It’s similar to how feedback loops help stabilize processes over time. This makes sure everything stays in balance.

Debits and Credits

The dual aspect of recording transactions is expressed through debits and credits:

| Account Type | Debit Effect | Credit Effect |

| Assets | Increase | Decrease |

| Liabilities | Decrease | Increase |

| Equity | Decrease | Increase |

| Revenue | Decrease | Increase |

| Expenses | Increase | Decrease |

Ledger Structure

The double entry system organizes financial information through a structured hierarchy:

- Journal: The chronological record of all transactions, showing debits and credits

- General Ledger: The collection of all accounts where transactions are categorized

- Trial Balance: A list of all accounts with their debit or credit balances to verify mathematical accuracy

- Financial Statements: Reports generated from the ledger data, including balance sheets and income statements

Applying the Double Entry System in Practice

Seeing theory in action is key. Let’s say a business buys $5,000 of inventory on credit. The entry would look like this:

Example:

Debit: Inventory (Asset) $5,000

Credit: Accounts Payable (Liability) $5,000

This simple record shows the system’s power. The business gains value (inventory) but also takes on a liability (debt). This keeps the books balanced.

This real-world approach shows how the system is more than math—it’s a thinking framework. Every financial move has two sides, just like every decision has trade-offs.

That’s what makes it so enduring.

This systematic approach to recording transactions in double-entry accounting ensures that the financial records provide a complete and accurate picture of a business’s economic activities, including the management of asset accounts and the balancing of debits credits.

Mental Models Behind the Double Entry System

The Double Entry System is more than a tool; it’s a mental model. It’s based on balance, feedback loops, and second-order thinking. Every debit must have a credit, making a closed system where every input has a mirrored output.

This mirrors systems thinking: small changes in one area affect the whole. The accounting equation—Assets = Liabilities + Equity—is not just math. It’s a rule of coherence, showing how actions ripple through a business.

By using dual-aspect reasoning in every transaction, the Double Entry System teaches us. It helps us spot imbalance, think about consequences, and understand cause and effect.

Modern Relevance of the Double Entry System

Despite being over 500 years old, the double entry system remains the foundation of modern accounting. Today’s digital tools have automated many aspects of the process, but the core principles remain unchanged.

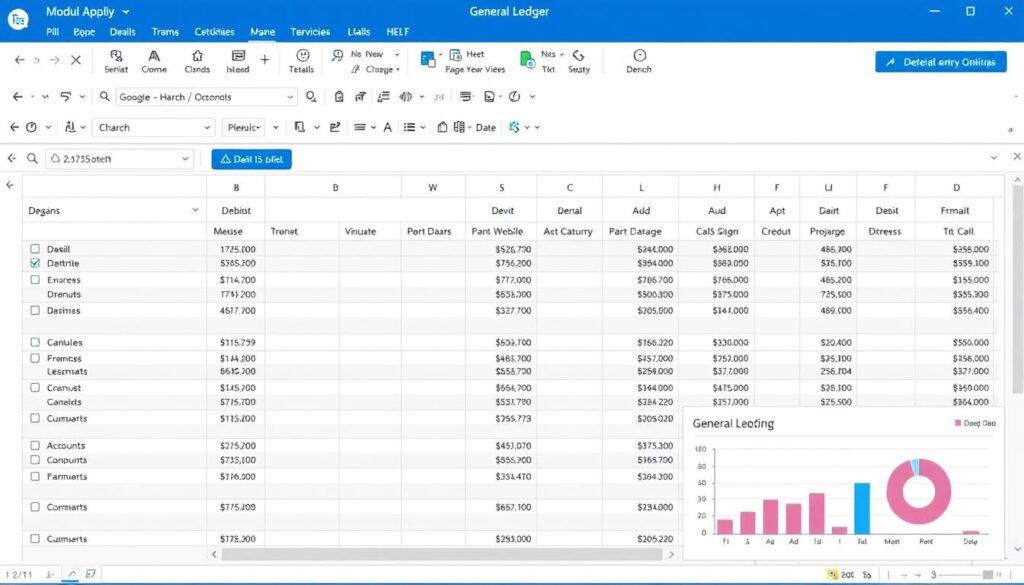

Modern accounting software implementing the double entry system

Digital Evolution

Modern accounting software has transformed how the double entry system is implemented:

- Automated journal entries that create corresponding debits and credits

- Real-time trial balances that instantly verify mathematical accuracy

- Integrated financial statements generated directly from ledger data

- Cloud-based systems allowing collaborative access across organizations

- AI-powered anomaly detection to identify potential errors or fraud

Regulatory Framework

The double entry system provides the structure needed to comply with modern accounting standards:

GAAP Compliance

Generally Accepted Accounting Principles require the use of double-entry accounting to ensure complete and accurate financial reporting.

International Standards

IFRS (International Financial Reporting Standards) builds upon the double-entry foundation to create globally consistent financial reporting.

Business Intelligence

The comprehensive nature of double-entry accounting provides rich data for business analysis:

- Complete financial history allowing trend analysis and forecasting

- Detailed categorization enabling profitability analysis by product, division, or region

- Audit trails that support governance and compliance requirements

- Data integrity that supports confident decision-making

The system doesn’t just track direct results—it reveals second-order effects. For example, increasing expenses today might improve efficiency and profit tomorrow. The Double Entry System supports this kind of deep thinking by documenting both short-term and long-term impacts.

The enduring relevance of the double entry system demonstrates how fundamental principles of double-entry accounting can transcend technological change in bookkeeping.

While the tools have evolved dramatically since Pacioli’s time, the core concept of balanced, dual-aspect recording remains as essential as ever for managing accounts in any business.

Evolution of the double entry system through history to modern applications

Conclusion: The Lasting Legacy of the Double Entry System

The Double Entry System is key in modern finance. It’s based on balance, transparency, and accountability. From ancient times to today’s digital age, it has stood the test of time.

This method works because it’s both mathematically sound and psychologically effective. It uses mirrored entries to spot mistakes, prevent fraud, and give a clear view of finances. Luca Pacioli made it official, but its true power lies in its ability to reflect deeper thinking.

Knowing the Double Entry System is not just for accountants. It’s for anyone who needs a solid way to handle complexity and understand cause and effect. It’s about making informed decisions and seeing the bigger picture.

Frequently Asked Questions

Did Luca Pacioli invent the double entry system?

No, Luca Pacioli did not invent the double entry system. He was the first to document and publish a comprehensive explanation of the method in his 1494 book “Summa de Arithmetica.” The system had already been in use by Italian merchants for at least two centuries before his publication.

How old is the double entry system?

The earliest complete double-entry records date back to 1340 in Genoa, Italy. However, precursors and partial implementations of double-entry concepts can be traced back much further, with elements appearing in ancient Roman, Islamic, and Asian record-keeping systems thousands of years ago.

Why is the double entry system still used today?

The double entry system remains in use because it provides a comprehensive and accurate view of financial position. Its self-balancing nature helps detect errors, prevents fraud, and produces complete financial statements. Modern accounting standards like GAAP and IFRS are built on double-entry principles, making it essential for regulatory compliance.

What are the main advantages of the double entry system?

The main advantages include: error detection through the balancing mechanism, complete financial picture showing both what is owned and owed, ability to generate comprehensive financial statements, audit trails for accountability, and rich data for business analysis and decision-making.