Ever wonder why some people seem to make smarter decisions when facing tough situations? It often comes down to seeing patterns in chaos—and that’s the probability distributions mental model. This approach helps you weigh possible outcomes, like guessing tomorrow’s weather or planning a product launch, by mapping out what’s likely versus what’s just a long shot in the world of uncertainty.

Think of it as a toolkit for handling life’s unpredictability. Instead of relying on gut feelings, you use data-driven reasoning to make informed decisions. For example, a product manager might analyze past sales trends to decide which features to prioritize.

This isn’t about crystal balls—it’s about using what you know to prepare for what you don’t, enhancing your understanding of the value of different outcomes.

Bayesian thinking plays a big role here. Imagine updating your assumptions as new information arrives, like adjusting your travel plans when a storm pops up on the radar. The goal? Turn vague hunches into actionable strategies by applying mental models that help you navigate the complexities of future events.

Key Takeaways

- Transforms guesswork into structured decision-making using mental models

- Helps adapt plans when new data emerges, improving accuracy in uncertain situations

- Useful for managing risks in business and daily life by understanding probabilities

- Combines historical patterns with current insights to enhance reasoning skills

- Makes complex scenarios easier to navigate through probabilistic thinking

By the end of this guide, you’ll see how tools like fat-tailed curves explain rare but impactful events—and how to apply these ideas to everything from career moves to weekend plans. Let’s dive in!

Introduction to Probabilistic Thinking

What if you could make better choices even when things are unclear? That’s the power of probabilistic thinking—a way to navigate life’s “what-ifs” by estimating how likely different outcomes are using mental models of probability.

Imagine deciding whether to leave early for a meeting: you weigh traffic patterns, weather reports, and your own punctuality habits. It’s not about being right every time, but making smarter bets with the knowledge and skills you have about the situation and the value of different probabilities.

Defining Probabilistic Reasoning

At its core, this approach asks: “What’s the chance this will happen?” Let’s say you’re planning a product launch. Instead of assuming everything will go perfectly, you might estimate a 70% chance of hitting deadlines and a 30% chance of delays.

By assigning rough probabilities to possibilities, you create a flexible roadmap that incorporates the concept of uncertainty and the value of different outcomes, not fragile.

The Importance of Thinking in Probabilities

Why does this matter? Because life rarely gives us perfect information. A farmer using a mental model to decide when to plant crops employs past weather data and current soil conditions—not guarantees.

Similarly, businesses apply probabilistic thinking and sales trends to predict demand, knowing that markets and situations can shift. This method turns vague worries into actionable plans, helping you prepare for multiple outcomes instead of banking on one.

Understanding Mental Models and Their Impact

How do successful leaders cut through confusion to make clear choices? They use mental models—frameworks that simplify how we interpret the world and make decisions based on probability.

Like a chef uses recipes to create dishes, these tools help us break down messy problems into manageable pieces, allowing people to apply probabilistic thinking to future outcomes.

Role in Decision-Making

Imagine a product team debating which feature to build next. A strong mental model—like the Eisenhower Matrix—helps sort tasks by urgency and importance, using concepts of probability to clarify the decision-making process. This turns endless debates into focused action. Good frameworks act like filters, highlighting what matters and hiding distractions.

Outdated models, however, can mislead. Think of a manager who only prioritizes speed over quality. By refining their approach—say, adopting First Principles Thinking—they learn to rebuild strategies from the ground up. This shift often reveals hidden opportunities and enhances their understanding of future outcomes.

Common Types of Mental Models

Popular models include:

- 80/20 Rule: Focus on the 20% of efforts driving 80% of results

- Second-Order Thinking: Ask, “What happens after the initial outcome?”

- Inversion: Solve problems by working backward from the desired goal

Teams using these tools make probabilistic reasoning part of their daily workflow. For example, a startup might combine data trends with customer feedback to predict market shifts. The result? Decisions rooted in clarity, not chaos.

Applying the Probability Distributions Mental Model

Ever felt stuck choosing between options when the future is foggy? This framework turns murky guesses into clear pathways. At its heart lie three ingredients: historical patterns, real-time updates, and flexible action plans.

Core Concepts Behind The Probability Distributions Mental Model

Think of it like weather forecasting for decisions. Meteorologists combine past climate data with live satellite information to predict storms. Similarly, this approach blends what you know (sales trends, customer feedback) with what’s unfolding (market shifts, team capacity). This mental model helps people understand the probability of various outcomes based on historical data and current events.

Here’s how it works in practice:

- A startup might assign likelihood scores to launch risks using past project delays

- A family adjusts vacation budgets by weighing flight price trends against emergency funds

Unlike gut reactions, this process encourages asking: “What’s changed since yesterday?” Maybe new competitor intel shifts your predictions. Or supplier delays force revised timelines.

Each update fine-tunes your roadmap, helping you apply probabilistic thinking to make decisions based on the best available knowledge.

Schools teach this through case studies—like analyzing why 83% of product launches miss deadlines. Businesses use it to allocate resources where they’ll have the most impact.

Over time, these structured choices become second nature, turning chaos into calculated moves, enhancing your understanding of the distribution of values in decision-making.

Bayesian Thinking: Updating Beliefs with Evidence

How do detectives solve cases when clues keep changing? They revise theories as new evidence appears—exactly what Bayesian thinking does for everyday choices.

This approach helps you adjust your views when fresh data arrives, turning rigid guesses into flexible strategies that reflect the probability of various outcomes and the underlying mental models people use to reason about events.

Explaining Bayes’ Theorem

Bayes’ Theorem is a math formula for updating beliefs. Here’s the simple version:

Updated Probability = (Initial Guess × New Evidence) ÷ Total Possibilities

Imagine a pregnancy test that’s 99% accurate. If 1% of women tested are pregnant, and someone gets a positive result, what’s the real chance they’re pregnant? Using Bayes’ math:

- 99% true positives (1% × 99% = 0.99%)

- 5% false positives (99% not pregnant × 5% = 4.95%)

Total positives = 0.99% + 4.95% = 5.94%. The actual probability? Just 0.99 ÷ 5.94 ≈ 17%. Surprising, right?

Real-World Example and Application

Think of planning a road trip. You check the weather app—30% rain chance. But dark clouds roll in halfway. A Bayesian thinker would bump that risk to 70% and pack rain gear. This process isn’t about perfection. It’s about making better decisions as facts evolve.

Businesses use this daily. A product team might shift launch dates after supplier delays. Or a farmer adjusts irrigation based on soil moisture sensors. Each update refines predictions, cutting risks before they blow up.

Try this today: Write down your initial guess for a decision. Then revise it when new information arrives. Over time, you’ll spot patterns others miss—and pivot faster when life throws curveballs.

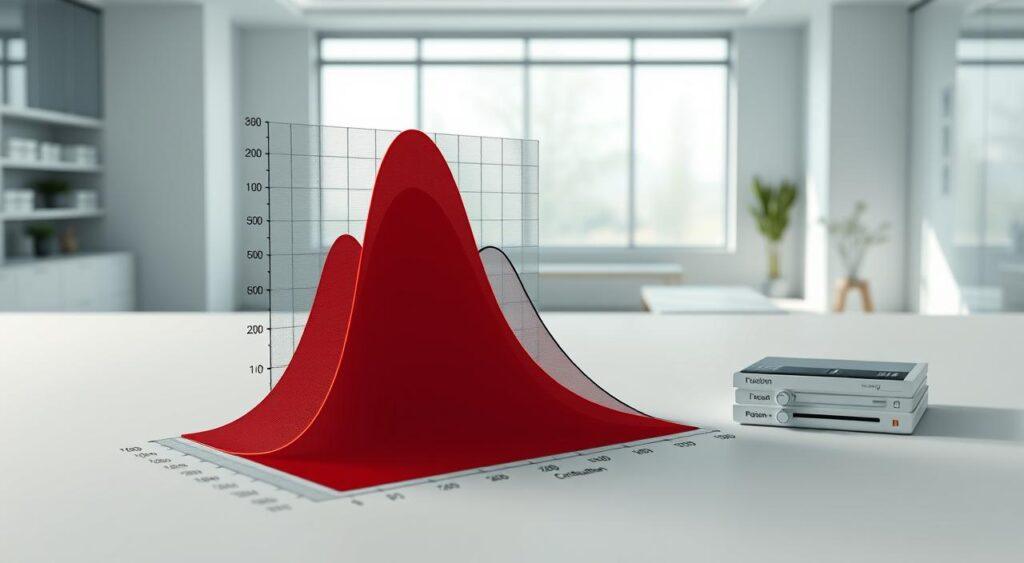

Exploring Fat-Tailed Curves and Their Implications

Why do some rare events—like housing market crashes or viral social media posts—catch us off guard? The answer often lies in the shape of the curve we use to predict them.

Most of us grew up with the classic bell-shaped normal distribution, where outcomes cluster around an average value. But life isn’t always that tidy, and our mental models of probability and event distributions can sometimes lead us astray.

Normal Distribution vs. Fat-Tailed Distribution

Picture school grades: most students score near the class average, with few failing or acing exams. That’s the bell curve. Now imagine home prices in a booming city. A few properties might sell for 10x the median—a “fat-tailed” pattern where extremes happen more often than the bell curve suggests, highlighting the concept of probability in our mental models of event distributions.

Assessing Extreme Outcomes

Fat-tailed distributions flip how we plan for risks. For example:

- Normal curve: Preparing for a “once-a-century” storm

- Fat-tailed curve: Building flood defenses because mega-storms occur every decade

This thinking changes how businesses approach uncertainty. Tech startups now budget for sudden regulatory changes, while investors hedge against black swan events like cryptocurrency crashes.

Why does this matter for everyday choices? If your data shows fat tails—like freelance income varying wildly month-to-month—you’d save more for dry spells. Recognizing these patterns helps you spot gaps in predictions and build tougher plans.

Unraveling Asymmetries in Decision-Making

Why do smart teams sometimes make baffling choices? Often, it’s because hidden biases tilt how we weigh risks and rewards. Decision asymmetries happen when we treat potential outcomes unevenly—like focusing too much on best-case scenarios while ignoring warning signs.

Understanding the probability of various events can help refine our mental models and theories about risk, leading to better decision-making. This concept allows people to reason through things more effectively, ensuring that we consider the full distribution of possible values and ideas behind each outcome.

Cognitive Biases and Over-Optimism

Imagine planning a software launch. Your team estimates six months, despite three past projects running late. This over-optimism—a common bias—skews how we process information. We anchor to hopeful guesses instead of asking: “What’s the worst that could happen?”

These imbalances affect both quick choices and long-term plans. A rushed product might gain short-term sales but damage trust. Conversely, excessive caution could delay innovations. The fix? Start by naming the bias. Write down three reasons your initial assumptions might be wrong. Consider the probability of various outcomes and how your mental models shape your reasoning.

Try this: Before finalizing a decision, ask, “What would a skeptical colleague question?” This simple check exposes blind spots. Over time, you’ll spot patterns—like assuming competitors won’t react to your moves—and adjust your thinking. Each event you analyze adds to your knowledge base, helping you refine your models.

By linking this to earlier ideas about updating beliefs, you create a feedback loop. Track how often your predictions match real outcomes. Refine your mental models as you go. Remember: Clarity grows when we confront our own biases head-on, ensuring we consider the full distribution of possible values and ideas behind each outcome.

Step-by-Step Guide to Probabilistic Decision-Making

Stuck choosing between options when outcomes are unclear? Let’s break down a practical method to turn guesswork into confident decisions based on probability and mental models. This approach works whether you’re picking schools for your kids or launching a new app feature, helping you evaluate different ideas and the potential value of each event.

Gathering and Analyzing Information

Start by asking: “What do I know, and what’s missing?” Imagine planning a family vacation. Check past travel costs, weather trends, and hotel reviews. Then list unknowns—like flight delays or local events.

This mix of data and uncertainty forms your starting point, helping you develop mental models that integrate knowledge and theory about potential outcomes. By considering different ideas and values, you enhance your reasoning as you evaluate the various things that could impact your plans.

Updating Your Beliefs With New Evidence

Found cheaper flights but worried about layovers? Revise your initial plan. Maybe budget extra time for connections. This process works like editing a draft—each new fact sharpens your predictions about potential outcomes and helps refine your mental models.

A project manager might adjust timelines after team feedback, just as you’d reroute a road trip for construction, considering various ideas and the value of each choice.

Putting It All Together

Combine insights into actionable steps:

- Rank likely outcomes from “almost certain” to “long shot”

- Create backup plans for top risks

- Schedule checkpoints to revisit your choices

Think of it as building with LEGO blocks—each piece (information, experience, new facts) snaps into your reasoning, helping you refine your mental models and concepts. Over time, you’ll spot patterns faster and make better calls under pressure.

Start small: Try this method tonight when deciding what’s for dinner!

Incorporating Data, Resources, and Statistical Tools

What separates confident choices from blind guesses? Often, it’s the tools we use to simplify complexity. By blending data, resources, and visual frameworks, you can turn messy problems into clear pathways.

Leveraging Information Effectively

Start by asking: “What do I already know, and what’s missing?” A small business owner might analyze sales trends to decide which products to stock. They’d combine past performance with customer surveys—turning scattered facts into actionable insights that enhance their mental models of the market.

Simple tools like spreadsheets or free analytics platforms help organize this information. For example, tracking monthly expenses reveals patterns in cash flow, which is crucial for understanding the overall outcome of business decisions.

This process cuts through noise, letting you focus on what truly impacts outcomes.

Using Decision Trees and Bayesian Networks

Decision trees map choices like a flowchart. Imagine deciding between two marketing strategies, a common scenario for many people in the business world:

- Option A: 60% chance of moderate sales growth

- Option B: 30% chance of high growth, 20% risk of losses

Visualizing these paths makes trade-offs obvious. Bayesian networks take it further by showing how events connect, illustrating the concept of interdependence.

For instance, supply chain delays might affect production timelines and customer satisfaction simultaneously, demonstrating the importance of these models in understanding complex systems.

| Tool | Use Case | Key Benefit |

|---|---|---|

| Decision Tree | Comparing job offers | Clarifies short-term vs. long-term gains |

| Bayesian Network | Project risk assessment | Shows ripple effects across teams |

These methods reduce bias by grounding reasoning in data. A study found teams using structured approaches to uncertainty made 42% fewer costly errors. Even basic tools—like pros/cons lists weighted by likelihood—can sharpen your decisions.

Remember: The goal isn’t perfection. It’s about making better bets with what you have. Try updating assumptions with fresh data during your next planning session. Small tweaks today build smarter systems for tomorrow.

Case Studies and Real-World Examples

How do top companies stay ahead in unpredictable markets? Let’s explore how real teams use structured approaches to tackle uncertainty. From tech launches to stock picks, these stories show the power of blending data with adaptable thinking and a solid set of knowledge and reasoning.

The theory behind these ideas is that the right people can turn challenges into opportunities, regardless of the things they face.

Product Roadmap Planning

A SaaS company faced a common dilemma: prioritize new features or improve existing tools? By analyzing user behavior data, they discovered 65% of customer complaints stemmed from just two pain points. Instead of guessing, they assigned likelihood scores to potential outcomes:

- 80% chance of higher retention with core upgrades

- 40% growth potential from flashy new tools

Result? Focusing on fixes first boosted satisfaction by 32% in six months. But they learned to update predictions quarterly—market trends shifted faster than expected.

Investment Decision-Making

An asset manager used historical patterns to balance portfolios. When crypto volatility spiked, they compared three scenarios:

| Strategy | Risk Level | 5-Year Return |

|---|---|---|

| Tech Stocks | High | +210% |

| Index Funds | Medium | +85% |

| Bonds | Low | +22% |

By allocating 60% to index funds and 40% to selective tech picks, they achieved steady growth while cushioning against crashes. Key takeaway? Balance beats betting it all on one outcome.

These examples prove one thing: Mapping likely outcomes helps teams navigate the unknown. Start small—apply this thinking to your next budget review or career move.

Navigating Uncertainty in Everyday Life Decisions

How do you stay calm when plans fall apart in this unpredictable world? Life throws curveballs—a canceled flight, a last-minute work crisis, or a sudden expense. These moments test our ability to balance risks and adapt.

The key isn’t avoiding surprises but building skills based on reasoning and theory to handle them gracefully, no matter the idea or things that come your way.

Assessing Risks and Likelihoods

Start by asking: “What’s the worst that could happen—and how likely is it?” Imagine your car breaks down before a big meeting. You might list possible outcomes:

- 10% chance of missing the meeting entirely

- 60% chance of arriving late

- 30% chance of finding a quick fix

Simple tools like this help you allocate time and money wisely. A parent might use similar thinking when choosing between school activities—weighing commute times against their child’s interests.

Adapting to Changing Circumstances

Flexibility turns panic into progress. When a storm cancels your beach day, pivot to indoor plans. Review your assumptions weekly. Did new information emerge? Maybe a friend’s recommendation changes your vacation spot.

| Situation | Initial Plan | Adaptation |

|---|---|---|

| Job interview delayed | Practice answers | Research company news |

| Concert sold out | Buy resale tickets | Host a themed dinner |

Small tweaks—like keeping backup snacks in your bag—add up. Investors use this process too, adjusting portfolios when markets shift. Remember: Uncertainty isn’t your enemy. It’s a chance to grow sharper skills for tomorrow’s challenges.

Developing Your Probabilistic Reasoning Skillset

What separates seasoned strategists from overwhelmed beginners? It’s not raw talent—it’s deliberate practice. Like a musician mastering scales, you can train your reasoning skills to handle life’s curveballs with calm precision.

Practical Exercises and Tools

Start with bite-sized challenges. Try guessing how many cars will pass through an intersection in five minutes—then count. Over time, you’ll notice patterns in traffic flow. Apps like GuessTheProbability turn this into a game, letting you test your hunches against real data.

Classic puzzles work too. The Monty Hall problem—where switching doors boosts winning chances—teaches counterintuitive understanding. Or simulate stock market decisions using pretend portfolios. These exercises build muscle memory for handling risk.

Overcoming Cognitive Biases

Our brains love shortcuts, but they often mislead. Ever overestimated snowfall chances because you remember last year’s blizzard? Track your predictions in a journal. Compare them to actual outcomes monthly. You’ll spot patterns like overconfidence in familiar scenarios.

Try this: Before major decisions, list three ways your assumptions might be wrong. A study found teams using structured reflection reduced costly errors by 37%. Small habits reshape mental models over time.

Progress comes through repetition. Set weekly reminders to revisit past choices. Celebrate when your skills help make better calls—like avoiding a rushed purchase after checking price trends. Each win fuels your confidence to tackle bigger uncertainties.

Tips for Roadmap and Strategic Planning

Navigating uncertainty in product development feels like steering a ship through fog—you need clear markers and backup routes. Start by aligning your team’s goals with what’s realistically achievable. For example, a SaaS company might prioritize features based on user behavior data, focusing on fixes that address 80% of complaints first.

Aligning Objectives with Probable Outcomes

Use the Kano Model to categorize features: essentials (“must-haves”), performance boosters, and delightful extras. A fintech app team discovered that adding biometric login (a “delight”) boosted retention by 18%, while payment gateway fixes (an “essential”) reduced support tickets by 40%.

This reasoning highlights the need to balance quick wins with long-term bets.

Contingency Planning in Uncertain Environments

Agile teams review roadmaps quarterly. When a tech firm faced supply chain delays, they shifted resources to software updates—a move informed by supplier risk scores. Always create “Plan B” scenarios:

- Allocate 15% of budgets to unexpected events

- Pre-draft pivot options for stalled projects

- Track leading indicators like customer sentiment shifts

| Focus Area | Traditional Approach | Probabilistic Approach |

|---|---|---|

| Timeline Planning | Fixed deadlines | Range-based estimates (e.g., Q3-Q4) |

| Resource Allocation | Static budgets | Flexible buckets adjusted monthly |

| Risk Handling | Single backup plan | Three-tiered response system |

Manage stakeholders by sharing information visually. A food delivery startup uses color-coded roadmaps showing high-impact projects in green and “nice-to-haves” in gray. This process turns abstract predictions into shared priorities—helping teams make better decisions when plans change.

Conclusion

Life’s unpredictability becomes manageable when you transform uncertainty into clarity. By adopting structured approaches like Bayesian updates and fat-tailed risk analysis, you turn vague guesses into informed decisions. These tools help you weigh what’s probable, prepare for extremes, and adapt when plans shift.

Key takeaways? First, probabilistic thinking isn’t about predicting the future—it’s about mapping possible outcomes. Second, regular practice sharpens your ability to spot biases and update assumptions. Third, combining historical patterns with fresh data builds resilience against surprises.

Start small. Try revising your next grocery list based on weather forecasts or adjusting weekend plans when friends cancel. Each exercise strengthens your reasoning muscles, enhancing your decision-making skills. Over time, you’ll notice patterns others miss and pivot faster when life throws curveballs.

Share your wins and lessons. Did reevaluating a career move using these methods lead to better results? Your story might inspire someone else.

Remember: Progress comes through doing, not perfection. Keep experimenting, stay curious, and watch how clarity replaces chaos.